READ AT

CUBICIN OFF PATENT IN 2016 IN US

JAPAN 2016

Blopress

BARACLUDE IN JAPAN IN 2016

ENTECAVIR, BARACLUDE

ENTECAVIR, BARACLUDE

Vfend (Voriconazole) IN UK

Vfend (Voriconazole) IN UK

According to a report by DCAT, based on IMS analysis, the following are some of the key patent expiries between 2014 and 2018.

- Nexium (esomeprazole): This patent expired in May 2014. Innovator AstraZeneca granted a license to Teva (TEVA) to produce the generic form in the United States.

- Celebrex (celecoxib): This patent expired in 2014. Pfizer conceded the drug to generic drug makers Actavis (ACT) and Teva after a prolonged lawsuit.

- Symbicort (budesonide/formoterol fumarate dihydrate): Some of AstraZeneca’s 13 patents have expired, but all won’t expire until 2023. No generic version of the drug exists.

- Crestor (rosuvastatin): AstraZeneca will lose its patent protection for Crestor in 2016.

- Cialis (tadalafi): Eli Lilly (LLY) is set to lose patent protection in the United States and Europe in 2017.

THE VIEWS EXPRESSED ARE MY PERSONAL AND IN NO-WAY SUGGEST THE VIEWS OF THE PROFESSIONAL BODY OR THE COMPANY THAT I REPRESENT, amcrasto@gmail.com, +91 9323115463 India

Ranking (by highest sales forecasts for 2020)

|

Drug |

Disease |

Pharmaceutical Company |

2020 Forecast Sales (US $ billions) |

|

|

1 |

Obeticholic acid |

Chronic liver diseases, primarily primary biliary cirrhosis |

Intercept Pharmaceuticals and Sumitomo Dainippon Pharma |

2.621 |

|

2 |

Emtricitabine + tenofovir alafenamide (F/TAF) |

HIV-1 infection |

Gilead Sciences and Japan Tobacco |

2.006 |

|

3 |

Tenofovir alafenamide + emtricitabine + rilpivirine (R/F/TAF) |

HIV-1 infection |

Gilead Sciences and Janssen R&D |

1.572 |

|

4 |

MK-5172A (grazoprevir + elbasvir) |

HCV infection |

Merck & Co |

1.537 |

|

5 |

Venetoclax |

Chronic lymphocytic leukemia |

Abbvie |

1.477 |

|

6 |

Nuplazid (pimavanserin) |

Parkinson’s disease psychosis |

ACADIA Pharmaceuticals |

1.409 |

|

7 |

Uptravi (selexipag) |

Pulmonary arterial hypertension |

Nippon Shinyaku Co and Actelion |

1.268 |

2016 DRUGS-TO-WATCH FORECAST SALES RANKINGS

Analysis based on data accessed on January 08, 2016.

(SOURCE: Thomson Reuters Cortellis)

SOME SELECTED STRUCTURES

1

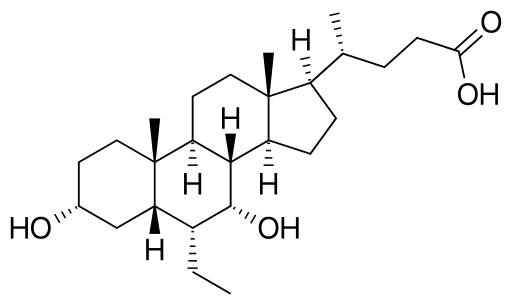

Obeticholic acid

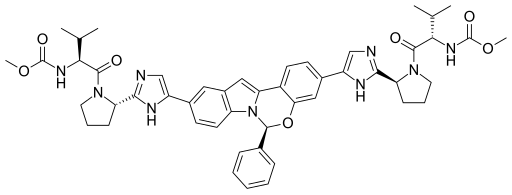

2Grazoprevir

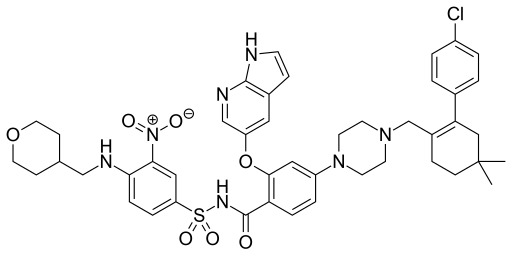

3 Venetoclax

4

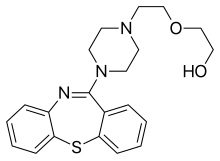

Pimavanserin

New Blockbuster Drugs to Watch in 2016

Each of these new drugs could rake in $2 billion in sales.

Blockbuster drugs, those medicines that bring in more than $1 billion in sales every year, are the holy grail of drug development. They can make a pharmaceutical company and send them to rock-star status among investors, as evidenced by the rise of Gilead Sciences after the launch of its hepatitis C treatments. This year’s slate of new drug launches features at least seven drugs expected to hit blockbuster status within the next five years, according to a study by Thomson Reuters.

The line-up also reveals key trends within the pharmaceutical industry for this year and beyond, including an increasing focus on rare diseases, the development of more convenient single-dose regimens, and more affordable treatments.

Here are the seven drugs set to launch this year and reach blockbuster status by 2020.

1. Intercept Pharmaceuticals and Sumitomo Dainippon Pharma

Drug: Obeticholic acid

Indication: Chronic liver diseases, primarily primary biliary cirrhosis

2020 Forecast Sales: $2.62 billion

Intercept Pharmaceuticals’ ICPT -7.35% obeticholic acid has proved very effective in treating non-alcoholic steatohepatitis, a type of liver inflammation caused by fat build-up in the organ. This condition has no approved treatment and a potentially large market, which is expected to push the drug to blockbuster status, if approved. About 2% to 3% of the global population has non-alcholoic steatohepatitis and the share will likely increase due to rising rates of pre-disposing factors like obesity and insulin resistance.

2. Gilead Sciences and Japan Tobacco

Drug: Emtricitabine and tenofovir alafenamide (F/TAF)

Indication: HIV-1 infection

2020 Forecast Sales: $2 billion

Gilead’s GILD -3.48% two HIV-1 infection drugs in development are both expected to be big money-makers, and the company is hoping the new daily single-dosage options will be able to replace sales of its existing HIV treatments that are set to lose patent protections in 2017. The new TAF-based therapies show evidence that they are potentially a safer replacement for some current therapies, including Gilead’s own Truvada.

3. Gilead Sciences and Janssen R&D

Drug: Tenofovir alafenamide and emtricitabine and rilpivirine (R/F/TAF)

Indication: HIV-1 infection

2020 Forecast Sales: $1.57 billion

Like the No. 2 drug on this list, Gilead’s secondary TAF-based combination therapy in partnership with Johnson & Johnson’s JNJ -1.49% Janssen unit is expected to improve renal and bone mineral density measurements compared with some existing drugs. Those results combined with the improved longevity of HIV patients and increasing numbers of those eligible for antiretroviral drugs means a large and lucrative market for the two new TAF-based drugs.

Tenofovir alafenamide

4. Merck & Co.

Drug: MK-5172A

Indication: Hepatitis C virus

2020 Forecast Sales: $1.54 billion

Merck MRK -3.12% is getting ready to enter the heated market for hepatitis C treatments, going up against Gilead’s Harvoni and Abbvie’s Viekira Pak. Following a significant setback when theFood and Drug Administration withdrew its “breakthrough drug” status, Merck’s treatment could finally launch this year to give another safe and high-quality treatment for the disease. A recent warning by the FDA concerning Viekira Pak has dampened sales of Abbvie’s drug, which could give Merck a leg up when it eventually brings its hepatitis C drug to market. It could also pursue an aggressive pricing strategy to gain market share, given the currently high price tags on current treatments.

5. Abbvie

Drug: Venetoclax

Indication: Chronic lymphocytic leukemia

2020 Forecast Sales: $1.48 billion

Abbvie’s ABBV -2.37% Venetoclax is a potential oral treatment for cancer, primarily focused on a type of chronic lymphocytic leukemia that is resistant to chemotherapy. The drug was a leading therapy at last year’s annual meeting of the American Society of Hematology after a clinical trial showed an overall response rate of 79.4% in patients with relapsed chronic lymphocytic leukemia. The drug is also being tested as a potential treatment for other hematological cancers like non-Hodgkin’s lymphoma, as well as in combination with tamoxifen in patients with metastatic breast cancer.

6. ACADIA Pharmaceuticals

Drug: Nuplazid

Indication: Parkinson’s disease psychosis

2020 Forecast Sales: $1.41 billion

ACADIA’s ACAD -6.18% nuplazid could be the first and only drug on the market to help treat Parkinson’s disease psychosis, which affects up to 40% of Parkinson’s patients. Clinical trials have shown that the drug does not worsen motor symptoms, a vital factor for these patients, while improving night-time sleep, daytime wakefulness, and caregiver burden. Nuplazid may also work in other psychosis settings, such as schizophrenia and Alzheimer’s disease psychosis. The combination of those three diseases means ACADIA’s drug has a potentially massive and therefore lucrative market.

7. Nippon Shinyaku and Actelion

Drug: Uptravi

Selexipag

Indication: Pulmonary arterial hypertension

2020 Forecast Sales: $1.27 billion

Nippon Shinyaky’s Uptravi is able to both delay the progression of pulmonary arterial hypertension, a type of high blood pressure that affects arteries in the lungs and heart, as well as reduce the risk of hospitalization. The drug is the only one on this list that’s already available. It entered the market in the first week of January 2016 and is expected to bring in $189 million in its first year, with sales increasing to $1.27 billion by 2020. Uptravi is being promoted as an additional therapy once baseline treatment has been started. A massive clinical trial showed that Uptravi reduced the risk of death from pulmonary arterial hypertension by 39% versus placebo.

2015

- Opdivo, Bristol-Myers Squibb, $5.684 billion

- Praluent, Regeneron Pharmaceuticals and Sanofi, $4.414 billion

- LCZ-696, Novartis, $3.731 billion

- Ibrance, Pfizer, $2.756 billion

- Iumacaftor plus ivacaftor, Vertex Pharmaceuticals, $2.737 billion

- Viekira Pak, AbbieVie, $2.500 billion

- Evolocumab, Amgen and Astellas Pharma, $1.862 billion

- Gardasil 9, Merck & Co., $1.637 billion

- Brexpiprazole, Ostuka Pharmaceutical and Lundbeck, $1.353 billion

- Toujeo, Sanofi, $1.265 billion

- Cosentyx, Novartis, $1.082 billion

SOME MORE STRUCTURES

Rilpivirine

Rilpivirine

Elbasvir

Elbasvir

Opdivo

Quetiapine

Quetiapine

A review of the drugs to watch in 2016 identifies several key areas of continued focus in the pharmaceutical industry: rare diseases, FDC regimens and pricing. The year ahead is anticipated to be a very interesting, and challenging, one for the pharmaceutical industry.

THE VIEWS EXPRESSED ARE MY PERSONAL AND IN NO-WAY SUGGEST THE VIEWS OF THE PROFESSIONAL BODY OR THE COMPANY THAT I REPRESENT, amcrasto@gmail.com, +91 9323115463 India