Drug Discovery, Hit to Lead

[slideshare id=58308997&doc=drug-discovery-hit-to-lead-160216071251]

/////

Drug Discovery, Hit to Lead

[slideshare id=58308997&doc=drug-discovery-hit-to-lead-160216071251]

/////

WEBSITE http://www.scientificupdate.co.uk/

TRAINING COURSE 2-3 DEC 2014

Process Development for Low Cost Manufacturing

When:02.12.2014 – 03.12.2014

Tutors:

Where: National Chemical Laboratory – Pune, India

Brochure:View Brochure

Register http://scientificupdate.co.uk/training/scheduled-training-courses.html

Chemical process research and development is recognised as a key function during the commercialisation of a new product particularly in the generic and contract manufacturing arms of the chemical, agrochemical and pharmaceutical industries.

The synthesis and individual processes must be economic, safe and must generate product that meets the necessary quality requirements.

This 2-day course presented by highly experienced process chemists will concentrate on the development and optimisation of efficient processes to target molecules with an emphasis on raw material cost, solvent choice, yield improvement, process efficiency and work up, and waste minimisation.

Process robustness testing and reaction optimisation via stastical methods will also be covered.

A discussion of patent issues and areas where engineering and technology can help reduce operating costs.

The use of engineering and technology solutions to reduce costs will be discussed and throughout the course the emphasis will be on minimising costs and maximising returns.

Conference 4-5 DEC 2014

TITLE . Organic Process Research & Development – India

Subtitle:The 32nd International Conference and Exhibition

When:04.12.2014 – 05.12.2014

Where:National Chemical Laboratory – Pune, India

Brochure:View Brochure

Register..http://scientificupdate.co.uk/conferences/conferences-and-workshops.html

for

Benefits

The efficient conversion of a chemical process into a process for manufacture on tonnage scale has always been of importance in the chemical and pharmaceutical industries. However, in the current economic and regulatory climate, it has become increasingly vital and challenging to do so efficiently. Indeed, it has never been so important to keep up to date with the latest developments in this dynamic field.

At this Organic Process Research & Development Conference, you will hear detailed presentations and case studies from top international chemists. The hand-picked programme of speakers has been put together specifically for an industrial audience. They will discuss the latest issues relating to synthetic route design, development and optimisation in the pharmaceutical, fine chemical and allied fields. Unlike other conferences, practically all our speakers are experts from industry, which means the ideas and information you take home will be directly applicable to your own work.

The smaller numbers at our conferences create a more intimate atmosphere. You will enjoy plenty of opportunities to meet and network with speakers and fellow attendees during the reception, sit-down lunches and extended coffee breaks in a relaxed and informal environment. Together, you can explore the different strategies and tactics evolving to meet today’s challenges.

This is held in Pune, close proximity to Mumbai city, very convenient to stay and travel to either in Pune or Mumbai. I feel this should be an opportunity to be grabbed before the conference is full and having no room

Hurry up rush

References

1 http://newdrugapprovals.org/scientificupdate-uk-on-a-roll/

2 http://scientificupdate.co.uk/conferences/conferences-and-workshops.html

3 http://en.wikipedia.org/wiki/Pune

PROFILES

Dr Will Watson gained his PhD in Organic Chemistry from the University of Leeds in 1980. He joined the BP Research Centre at Sunbury-on-Thames and spent five and a half years working as a research chemist on a variety of topics including catalytic dewaxing, residue upgrading, synthesis of novel oxygenates for use as gasoline supplements, surfactants for use as gasoline detergent additives and non-linear optical compounds.

In 1986 he joined Lancaster Synthesis and during the next 7 years he was responsible for laboratory scale production and process research and development to support Lancaster’s catalogue, semi-bulk and custom synthesis businesses.

In 1993 he was appointed to the position of Technical Director, responsible for all Production (Laboratory and Pilot Plant scale), Process Research and Development, Engineering and Quality Control. He helped set up and run the Lancaster Laboratories near Chennai, India and had technical responsibility for the former PCR laboratories at Gainesville, Florida.

He joined Scientific Update as Technical Director in May 2000. He has revised and rewritten the ‘Chemical Development and Scale Up in the Fine Chemical & Pharmaceutical Industries’ course and gives this course regularly around the world. He has been instrumental in setting up and developing new courses such as ‘Interfacing Chemistry with Patents’ and ‘Making and Using Fluoroorganic Molecules’.

He is also involved in an advisory capacity in setting up conferences and in the running of the events. He is active in the consultancy side of the business and sits on the Scientific Advisory Boards of various companies.

………………………………………………………………………………………………….

Dr John Knight gained a first class honours degree in chemistry at the University of Southampton, UK. John remained at Southampton to study for his PhD in synthetic methodology utilizing radical cyclisation and dipolar cyloaddition chemistry.

After gaining his PhD, John moved to Columbia University, New York, USA where he worked as a NATO Postdoctoral Fellow with Professor Gilbert Stork. John returned to the UK in 1987 joining Glaxo Group Research (now GSK) as a medicinal chemist, where he remained for 4 years before moving to the process research and development department at Glaxo, where he remained for a further 3½ years.

During his time at Glaxo, John worked on a number of projects and gained considerable plant experience (pilot and manufacturing). In 1994 John moved to Oxford Asymmetry (later changing its name to Evotec and most recently to Aptuit) when it had just 25 staff. John’s major role when first at Oxford Asymmetry was to work with a consultant project manager to design, build and commission a small pilot plant, whilst in parallel developing the chemistry PRD effort at Oxford Asymmetry.

The plant was fully operational within 18 months, operating to a 24h/7d shift pattern. John continued to run the pilot plant for a further 3 years, during which time he had considerable input into the design of a second plant, which was completed and commissioned in 2000. After an 18-month period at a small pharmaceutical company, John returned to Oxford in 2000 (by now called Evotec) to head the PRD department. John remained in this position for 6.5 years, during which time he assisted in its expansion, established a team to perform polymorph and salt screening studies and established and maintained high standards of development expertise across the department.

John has managed the chemical development and transfer of numerous NCE’s into the plant for clients and been involved in process validations. He joined Scientific Update in January 2008 as Scientific Director.

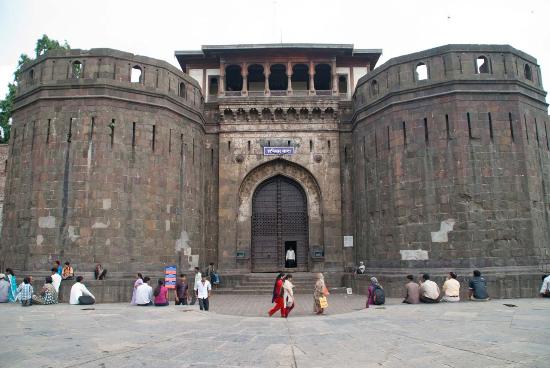

Pune images

From top:1 Fergusson College, 2 Mahatma Gandhi Road, Shaniwarwada 3 the HSBC Global Technology India Headquarters, and the 4National War Memorial Southern Command

NCL PUNE

The National Chemical Laboratory is located in the state of Maharashtra in India. Maharashtra state is the largest contributor to India’s GDP. The National Chemical Laboratory is located in Pune city, and is the cultural capital of Maharashtra. Pune city is second only to Mumbai (the business capital of India) in size and industrial strength. Pune points of interest include: The tourist places in Pune include: Lal Deval Synagogue, Bund Garden, Osho Ashram, Shindyanchi Chhatri and Pataleshwar Cave Temple.

The National Chemical Laboratory is located in the state of Maharashtra in India. Maharashtra state is the largest contributor to India’s GDP. The National Chemical Laboratory is located in Pune city, and is the cultural capital of Maharashtra. Pune city is second only to Mumbai (the business capital of India) in size and industrial strength. Pune points of interest include: The tourist places in Pune include: Lal Deval Synagogue, Bund Garden, Osho Ashram, Shindyanchi Chhatri and Pataleshwar Cave Temple.

MAKE IN INDIA

http://makeinindia.com/sector/pharmaceuticals/

Read all about Organic Spectroscopy on ORGANIC SPECTROSCOPY INTERNATIONAL

KEYWORDS

JOHN KNIGHT, WILL WATSON, SCIENTIFIC UPDATE, PROCESS, COURSE, CONFERENCE, INDIA, PUNE, PROCESS DEVELOPMENT, LOW COST, MANUFACTURING, SCALEUP

End to end solutions Big Data push to research In Green / shutterstock.com

What is the secret sauce of accelerating innovation when it comes to critical areas such as drug discovery, personalised medicines or simulated healthcare? Embracing continual innovation was always an imperative for the life sciences companies to stay relevant, and stay alive. This is not just confined to the new drug discovery team within the company, it spans the entire value chain of the innovation ecosystem. The question is whether enough is being done to drive R&D innovation in the pharmaceutical industry.

read all at

http://m.thehindubusinessline.com/opinion/a-smarter-way-to-find-new-drugs/article6435802.ece/

Lupin Limited

news

Expanding domestic portfolio, ability to maintain market share in current products and new launches are key growth triggers

The lipid control or cholesterol lowering segment is emerging as a key growth driver for Lupin’s sales in the US. The first among three products is Tricor. The Lupin stock had corrected about five per cent in May on the announcement that Mylan would launch the $1.2 billion (Rs 7,200 crore) drug in tablet form.

Lupin has been able to maintain its generic market share so far with a share of 34 per cent vis-a-vis Mylan (market share of one-two per cent). While Balaji Prasad and Rohit Goel of Barclays estimate the drug will contribute about $29 million to Lupin’s revenues in the June 2014 quarter, Ebitda margins are expected to expand by 210 basis points, feel analysts at Kotak Securities.

Though the launch of generics in capsule form by Mylan has to be watched carefully, Lupin’s Antara, along with authorised generics, continues to dominate with 70 per cent share, observes Hitesh Mahida at Fortune Research.

In addition to Tricor, two other products in the cholesterol lowering segment the company is eyeing are Trilipix and Niaspan. Instead of a launch in January 2014 as was anticipated earlier, the company is now likely to launch the generics version of this $550 million drug Trilipix this month.

While the company says it is mulling options about the launch, Edelweiss analysts believe an early launch is likely to add $11 million in FY14 and about $15 million in FY15 to the company’s revenues. The third drug in this segment is Niaspan, to be launched in March 2014 and expected to add about $35 million to the company’s revenues in FY15. Together, the three cholesterol controlling drugs are expected to contribute $85-90 million to FY15 sales for Lupin.

Lupin Limited is a transnational pharmaceutical company based in Mumbai. It is the 2nd largest Indian pharma company by market capitalization;[14] the 14th largest generic pharmaceutical company globally[15] and; the 5th largest generic pharmaceutical company in the US by prescription-led market share.[16] It has the distinction of being the fastest growing generic pharmaceutical player in the two largest pharmaceutical markets of the world – the US[17] and Japan;[18] and is the 5th largest [19] and the fastest growing generic pharmaceutical player in South Africa.[20]

Market Position in the US gradually improving

Lupin 5thlargest generic company in the US in terms of prescriptions

14 products are market leader and 27 (among top 3) out of 30

| Type | Public |

|---|---|

| Traded as | BSE: 500257 NSE: LUPIN |

| Industry | Pharmaceuticals |

| Founded | 1968 [1] |

| Founder(s) | Dr. Desh Bandhu Gupta[2] |

| Headquarters | Mumbai, Maharashtra[3], India |

| Key people | Dr. Kamal K Sharma, Vice Chairman;[4]

…………………. Nilesh Gupta, Managing Director;[6]

……………

…………………….

…………………….

New leadership team at Lupin from September 2013[10] |

| Products | Pharmaceuticals, branded andgeneric drugs, biotechnology, Advanced Drug Delivery Systems, New Chemical Entity Research, vaccines, Over-the-Counter drugs |

| Revenue | |

| Profit | |

| Employees | 11355[13] |

| Subsidiaries | Lupin Pharmaceuticals, Inc. Kyowa Pharmaceutical Industry Co. Ltd. I’rom Pharmaceutical Co. Ltd. Pharma Dynamics Multicare Pharmaceuticals Generic Health Pte. Ltd. Hormosan Pharma GmbH |

| Website | www.lupinworld.com |

2012 .http://icra.in/Files/ticker/Indian%20Pharmaceutical%20Sector.pdf

Lupin was founded in 1968 by Dr. Desh Bandhu Gupta,[21] then an Associate Professor at BITS-Pilani, Rajasthan. Named after the Lupin flowerbecause of its inherent qualities and what it personifies and stands for, the company was created with a vision to fight life threatening infectious diseases and to manufacture drugs of the highest social priority.

Lupin first gained recognition when it became one of the world’s largest manufacturers of tuberculosis drugs.[22] The company today has a significant market share in key markets in the Cardiovascular (prils and statins), Diabetology, Asthma, Pediatrics, CNS, GI, Anti-Infectives and NSAIDs therapy segments. It also has a global leadership position in the Anti-TB and Cephalosporin segments. The company’s R&D endeavours have resulted in significant progress in its NCE program. Lupin’s foray into Advanced Drug Delivery Systems has resulted in the development of platform technologies that are being used to develop value-added generic pharmaceuticals. Its manufacturing facilities, spread across India and Japan, have played a critical role in enabling the company realize its global aspirations. Benchmarked to International standards, these facilities are approved by international regulatory agencies including the US FDA, UK MHRA, Japan’s MHLW, TGA Australia, WHO, and the MCC South Africa.

Lupin’s Research Program covers the entire pharma value chain. The company’s global R&D program is headquartered out of the Lupin Research Park located near Pune that houses over 1200 scientists. Lupin’s R&D covers:

Differentiation is the heart of our research efforts at Lupin. We have created a truly unique world-class research program, designed to ensure a sustainable pipeline of high-value opportunities to maximise growth.

Research and Development is at the core and is the most critical part of any pharmaceutical company. At Lupin we see R&D differently. It is fundamentally about creativity, originality and being aware of what is really required. At Lupin, our Research & Development program has been the key to our sustained growth over the past ten years; growth that has made us one of the most exciting research driven pharmaceutical companies globally; a hotbed of differentiation and innovation. Today we are building the future by strengthening our research foundation through prudent investments that position us at the cutting-edge of technology, helping us deliver complex products that very few in the world can.

Headquartered at the state-of-the-art Lupin Research Park in Pune, India, the Company’s research program is home to over 1,400 scientists. The Company’s global research operations are spread over multiple research facilities in India and Japan. During FY 2013, the Company invested 7.5% of its net sales in Research & Development and related spends, amounting to 7,098 million. FY 2013 was a record year in terms of progress made all around, be it our pace of filing DMFs (Drug Master Files) and ANDAs (Abbreviated New Drug Applications), progress in our drug discovery and development program, milestones in our drug delivery program and approvals in our biotechnology program.

Long-term, one of the Company’s biggest differentiators will be its Novel Drug Discovery and Development (NDDD) program. The Program focuses on the discovery, development and commercialisation of new drugs that address disease areas with significantly unmet medical need. Lupin’s NDDD efforts are directed towards identifying and developing new therapies for disease areas that include metabolic/endocrine disorders, pain and inflammation, autoimmune diseases, CNS disorders, cancer and infectious diseases.

Scientists at NDDD have been able to create a portfolio of novel compounds that are moving through a robust pipeline from discovery to development. This steady movement will ensure that at least one compound enters the clinical phase in terms of first-in-human studies each year. Lupin has adopted a ‘Quick-win, fail-fast’ cost-efficient development approach, in which novel compounds are filtered at every stage before entering development and differentiated by efficacy with a focus on enhanced safety.

Highlights, FY 2013

Successfully completed Phase I studies in Europe for a program in the CNS area, which is being advanced to Phase II clinical trials in Europe now

Therapeutic Targets

| Therapy Area | Differentiated Pipeline |

| METABOLIC / ENDOCRINE DISEASES | NOVEL MECHANISMS FOR NEW ANTI-DIABETICS |

| PAIN / INFLAMMATION | HOLY GRAIL OF PAIN REMEDY |

| AUTO-IMMUNE DISEASES | TARGETED FOR RHEUMATOID ARTHRITIS AND OTHER IMMUNE DISORDERS |

| CNS DISORDERS | ROBUST TREATMENTS FOR COGNITIVE DEFICITS IN DIFFERENT CNS CONDITIONS |

| ONCOLOGY | HIGHLY DIFFERENTIATED ANTI-CANCER TREATMENT (HITTING ONLY CANCER CELLS) |

| INFECTIOUS DISEASES | HIGHLY POTENT ANTI-VIRAL THERAPY |

Lupin’s businesses encompass the entire pharmaceutical value chain, ranging from branded and generic formulations, APIs, advanced drug deliverysystems to biotechnology. The company’s drugs reach 70 countries[23] with a footprint that covers Advanced Markets such as USA, Europe, Japan,[24] Australia as well as Emerging Markets including India,[25] the Philippines and South Africa to name a few.

KEY MARKETS AND BUSINESSES

USA

Headquartered in Baltimore, Maryland, Lupin Pharmaceuticals, Inc. (LPI), the company’s US subsidiary is a $ 706 million enterprise.[26] LPI has a presence in the branded and generics markets of the US. In the branded business, Lupin operates in the CVS and Pediatric segments. The company is the market leader in 24 products out of the 46 products marketed in the US generics market, of which it is amongst the Top 3 by market share in 37 of these products (IMS Health, March 2013): Suprax (Cefixime), a paediatric antibiotic, is Lupin’s top-selling product here. The company is also the 5th largest and fastest growing generics player in the US (5.3% market share by prescriptions, IMS Health). Lupin’s US brands business contributed 21% of total US sales whereas the generics business contributed 79% during FY 2012-13.[26]

In the US market, since December 2012, Lupin has posted a 40-80 per cent growth rate on the back of new launches, as well as growing sales of its existing drugs. For May, the company has posted growth of 50 per cent year-on-year in US sales. The outlook is also good. On the whole, Lupin has one of the strongest pipelines of 18-20 products for the US market over the next 18 months.

Robust US sales continue

Despite the 51 per cent rise in share price over six months, most analysts continue to be bullish on the company due to its strong showing in the US market. Among leading Indian pharma majors, this geography contributes nearly 40 per cent of its revenues, second only to Sun (43 per cent) and a good performance rubs off well on the company’s overall show.

About half its US sales are contributed by Antara, the generic form of the cholesterol lowering drugTricor, antibiotics Suprax and Cefdinir and the generic form of antipsychotic drug Geodon. Among other segments expected to drive growth are oral contraceptives ($100 million estimated sales in FY14), dermatology, ophthalmology and asthama.

India Region Formulations (IRF)

Lupin’s IRF business focuses on lifestyle and chronic therapy segments. The company has emerged as one of the fastest growing players in therapies like Cardiology, Central Nervous System(CNS), Diabetology, Anti-Asthma, Anti-Infective, Gastro Intestinal and Oncology. The IRF business contributed 25% of the company’s overall revenues for FY 2012-13, growing by 24% and recording revenues of ![]() 2364 crore (US$380 million) for FY 2012-13 as compared to

2364 crore (US$380 million) for FY 2012-13 as compared to ![]() 1905 crore (US$300 million) for FY 2011-12.[26]

1905 crore (US$300 million) for FY 2011-12.[26]

There are 9 manufacturing plant and 2 Research pant in India, such as Jammu(J&K),Mandideep & Indore(Madhya pradesh), Ankaleswar & Dabasa (Gujarat), Tarapur, Aurangabad and Nagpur (Maharastra) and Goa; where research centre at Pune and Aurangabad.[27] Among these the baby plant is Nagpur plant which will the the biggest formulation unit for Lupin in coming year.

Lupin is also gradually expanding its domestic portfolio through expansion into more segments and tie-ups. On Thursday, it announced a non-exclusive tie-up with US-basedMerck Sharp and Dohme (MSD) for marketing the latter’s pneumococcal vaccine (preventive care for diabetes and, chronic heart, lung and liver diseases) for adults.

Given its growth, Bank of America Merrill Lynch analysts believe the valuation multiple at 20 times FY15 earnings estimates is likely to expand (closer to larger peers) due to stronger and sustainable growth rates, both on the net profit front (22 per cent annually over the next two years) and return ratios, expected at 30 per cent versus 26 per cent for the peers. Most analysts have a target price of Rs 875-900 for the stock. Though a re-rating could be on the cards, given the surge in share price, investors should look at corrections to add the scrip to their portfolio.

Europe

Lupin’s focus in the European Union encompasses Anti-Infectives, Cardiovascular, and CNS therapy areas, along with niche opportunities in segments like Oral Contraceptives, Dermatology and Ophthalmics. The company’s presence in France is by way of a trade partnership; in Germany, it operates through its acquired entity Hormosan Pharma GmbH (Hormosan);[28] while the UK business is a direct-to-market initiative.

Japan

Lupin is the fastest-growing Top 10 generic pharmaceuticals player in Japan (IMS). Lupin operates in Japan through its subsidiary, Kyowa Pharmaceutical Industry Co. Ltd. (Kyowa), a company Lupin acquired in 2007,[29][30] and I’rom, Pharmaceutical Co. Ltd (IP), acquired in 2011.[31][32] Kyowa has an active presence in Neurology, Cardiovascular, Gastroenterology and the Respiratory therapy segments. I’rom is a niche injectables company with significant presence in the DPC hospital segment.

South Africa

Lupin’s South African subsidiary, Pharma Dynamics (PD)[33] is the fastest growing and the 5th largest generic company in the South African market (IMS). The company is a market leader in the Cardiovascular segment and has a growing presence in Neurology, Gastroenterology and the Over the Counter (OTC) segments.

Australia

Lupin entered the Australian market through its subsidiary, Generic Health Pte. Ltd. (GH).[34] It subsequently acquired the worldwide marketing rights to the over 100 year old Australian brand Goanna,[35] used for pain management.

Philippines

Lupin’s Philippines subsidiary Multicare Pharmaceuticals (Multicare),[36] is a branded generic company focused on Women’s Health, Pediatrics, Gastro-Intestinal and Diabetes care. FY 2012 also marked its foray into the Neurology segment when it entered into a strategic marketing partnership with Sanofi.[37]

API and Global TB

Lupin is one of the most vertically integrated global generic majors and a global leader in Cephalosporins, Cardiovasculars and the anti-TB space. The company is also a strategic supplier of anti-TB products to the Global Drug Facility (GDF), with its formulations being supplied to more than 50 countries through GDF procurement.

Lupin is also a global leader in anti-TB APIs, and is associated with the Revised National TB Program of the Government of India, thereby partnering the Government in its fight against TB in the country. It also supplies to various Government agencies, the Stop TB Partnership and various other international agencies like Pan America Health Organisation (PAHO), Médecins Sans Frontières (MSF) and the Damien Foundation. Ethambutol, Rifampicin and Pyrazinamide are the company’s top selling TB molecules.

Biotechnology Research

The Lupin Biotechnology Research Group, based out of Wakad, near Pune is focussed on developing affordable, high quality biopharmaceuticals with an emphasis on biosimilars. As of May 2013, it has a pipeline of 10 biosimilar products under development, and is close to getting marketing authorization for 2 of its oncology products for the Indian market. Lupin has competencies for the complete development and manufacture of recombinant protein therapeutic products from high yielding and proprietary microbial and mammalian cell culture platforms. The Biotech R&D infrastructure offers a range of product development capabilities ranging from clone development, process optimization, analytical method development, bioassay, formulation, stability studies, non-clinical and clinical studies backed by a sound understanding of regulatory and IP aspects. The company’s biotech development programs are in compliance of and follow ICH, EMEA and Indian Regulatory guidelines.

To further its social responsibility objectives, Lupin established the Lupin Human Welfare & Research Foundation (LHWRF) on 2 October 1988. Its chief objective was to provide an alternative sustainable, replicable and ever evolving model of holistic rural development. LHWRF started with a few small rural development projects covering around 35 villages in Bharatpur District,Rajasthan. Its efforts have touched the lives of over a million people across 2,200 villages in the states of Rajasthan, Madhya Pradesh, Maharashtra and Uttarakhand.

ANKLESHWAR GUJARAT PLANT INDIA

![]()

LUPIN TARAPUR INDIA

LUPIN GOA INDIA

Oncologyand inflamation

Lupin is building a discovery pipeline with over seven to eight molecules targeting the oncology and inflammation segments.

Lupin is building a discovery pipeline with over seven to eight molecules targeting the oncology and inflammation segments. The company, producing both branded and generic drugs, is also planning an investment of $20 million to expand and build additional facilities and capacities exclusively for biologics in Pune in next two to three years.

“We have over seven to eight molecules in the pipeline. Of these, three are already undergoing clinical trials, while two are in pre-clinical stage. One more molecule will be entering pre-clinical stage soon,” Cyrus Karkaria, Lupin president said, adding that the company was gearing up to launch a new product this year. He also indicated that some of these lead molecules could be potential out-licensing targets at some point of time.

Biosimilar products include recombinant erythropoietin, recombinant granulocyte colony stimulating factor (G-CSF), interferon alpha and beta, human insulin, monoclonal antibodies and human growth hormone. These are used oncology, infectious diseases, chronic autoimmune diseases, growth-related deficiencies and haematology.

As part of its expansion, Lupin will be expanding facilities in Pune, which will be operational in next two to three years. “We currently have a production facility near the lab. We will be building additional facilities with about $20 million investment in next two to three years,” Cyrus explained. Last year, the company announced plans to invest over R450 crore towards capacity expansion and strengthening sales force. Lupin is also gearing up to launch its first biosimilar product in India by early next year besides targeting 5-7% of its business from biosimilar business.

The company had entered into a licensing agreement with Sydney-based NeuClone for cell-line technology which will provide exclusive proprietary cell-line technology to be developed into biosimilar drugs targeting cancer.

Several drug companies, including Dr Reddy’s, Cipla and Biocon, among others, are eying the opportunity in biosimilars. Industry estimates global market for biosimilars or follow-on biologic drugs is about $100 billion and the Indian market is about R2,500 crore.

Meanwhile, the US Food and Drug Administration has issued three guidances on biosimilar product development to assist industry in developing such products in the US. These draft documents are designed to help industry develop

About Lupin Limited

Lupin is an innovation led transnational pharmaceutical company producing and developing a wide range of branded and generic formulations and APIs globally. The Company is a significant player in the Cardiovascular, Diabetology, Asthma, Pediatric, CNS, GI, Anti-Infective and NSAID space and holds global leadership positions in the Anti-TB and Cephalosporin segment.

Lupin is the 5th largest and fastest growing top 5 generics player in the US (5.3% market share by prescriptions, IMS Health) and the 3rd largest Indian pharmaceutical company by revenues. The Company is also the fastest growing top 10 generic pharmaceutical players in Japan and South Africa (IMS).

For the financial year ended March 2013, Lupin’s Consolidated turnover and Profit after Tax were Rs. 94,616 million (USD 1.74 billion) and Rs. 13,142 million (USD 242 million) respectively. Please visithttp://www.lupinpharmaceuticals.com for more information.

Mumbai, February 03, 2014: Pharmaceutical major Lupin Limited announced the acquisition of Nanomi B.V. in the Netherlands today. With this acquisition, Lupin has made its foray into the technology intensive complex injectables space.

Nanomi has patented technology platforms to develop complex injectable products. Nanomi has a rich talent pool of scientists who would be backed by Lupin’s global R&D and manufacturing teams.

Commenting on the acquisition Ms. Vinita Gupta, Chief Executive Officer, Lupin Limited said “We are very pleased with the acquisition of Nanomi. With the use of Nanomi’s proprietary technology platform, Lupin would be able to make significant in-roads into the niche area of complex injectables.”

Mumbai, Baltimore, December 18, 2013: Pharma Major Lupin Limited (Lupin) announced today that its US subsidiary Lupin Pharmaceuticals Inc. has launched its Abacavir Sulfate, Lamivudine, and Zidovudine Tablets, 300 mg (base) / 150 mg / 300 mg in the US after the US District Court for the District of Delaware ruled that the Lupin’s generic version of Trizivir® did not infringe on patents. Lupin had earlier received approval for the same.

Lupin’s Abacavir Sulfate, Lamivudine Zidovudine 300mg (Base)/150mg/300mg Tablets are the AB-rated generic equivalent of ViiV Healthcare’s (ViiV) Trizivir® Tablets, 300 mg (base) / 150 mg / 300mg and are indicated in combination with other antiretrovirals or alone for the treatment of HIV-1 infection.

Lupin is the first applicant to file an ANDA for Trizivir® Tablets and as such is entitled to 180 days of marketing exclusivity.

Trizivir® Tablets, 300 mg (base) / 150 mg / 300mg had annual U.S sales of approximately US$ 111.6 million (IMS MAT Sep, 2013).

Mumbai, Baltimore, December 12, 2013: Pharma Major Lupin Limited (Lupin) announced today that its US subsidiary, Lupin Pharmaceuticals, Inc. (LPI) has launched its Duloxetine Hydrochloride Delayed-release (HCl DR) Capsules 20 mg, 30 mg and 60 mg strengths. The Company received final approval to market its Duloxetine HCl DR Capsules USP, 20 mg, 30 mg, 40 mg and 60 mg strengths from the United States Food and Drugs Administration (FDA) yesterday.

Lupin’s Duloxetine HCl DR Capsules 20 mg, 30 mg and 60 mg strengths are the generic equivalent of Eli Lilly & Company’s (Lilly) Cymbalta® Delayed-release Capsules 20 mg, 30 mg and 60 mg.

Duloxetine HCl DR Capsules are indicated for the treatment of major depressive disorder (MDD), generalized anxiety disorder (GAD) and management of neuropathic pain (DPNP) associated with diabetic peripheral neuropathy.

Cymbalta® Delayed-Release Capsules 20 mg, 30 mg and 60 mg strengths had annual U.S sales of approximately USD 5.43 billion (IMS MAT Sep, 2013).

|

Lupin launches Generic Trilipix® Delayed – Release Capsules 45 mg & 135 mg in the US |

|

Mumbai, Baltimore, December 06, 2013: Pharma Major Lupin Limited (Lupin) announced today that its US subsidiary, Lupin Pharmaceuticals, Inc. (LPI) has launched its generic Fenofibric Acid Delayed‐Release Capsules 45 mg and 135 mg. Lupin had earlier received final approval from the US FDA for the same. Lupin�s Fenofibric Acid Delayed‐Release Capsules 45 mg and 135 mg are the generic equivalent of AbbVie Inc.�s Trilipix® Delayed‐Release Capsules 45 mg & 135 mg strengths are indicated as co‐administration therapy with statins for the treatment of mixed dyslipidemia, treatment of severe hypertriglyceridemia and primary hypercholesterolemia or mixed dyslipidemia. Trilipix® Delayed‐Release Capsules 45 mg & 135 mg strengths had annual U.S sales of approximately US$ 449.5 million (IMS MAT Sep, 2013). |

Tadataka Yamada, M.D., Chief Medical & Scientific Officer of Takeda

TAKEDA US CHICAGO OFFICE

TAKEDA PIPELINE SEE LINKS BELOW

1 https://www.takeda.com/investor-information/annual/files/ar2013_10_en.pdf

2. http://www.takeda.com/research/files/pipeline_20131031_en.pdf

3 http://www.takeda.com/research/pipeline/

Takeda’s top executives had frequently pointed to TAK-875 as one of their best shots at coming up with an important new approach to treating diabetes. The drug is designed to spur insulin secretion in the pancreas and Takeda had confidently projected an approval in Japan in 2015 with a follow-up approval in the big U.S. market a year or two later.

The termination of the high-profile program caused some anxiety among investors. Takeda’s shares plunged 8% on the loss as analysts wondered how the pharma company could counter the loss of Actos, a $3.7 billion drug that accounted for about a quarter of its revenue in 2011.

Takeda won an approval on a trio of DPP-4 diabetes drugs–Nesina (alogliptin) and two combos with alogliptin, dubbed Oseni and Kazano–at the beginning of the year. But Takeda suffered some big delays in gaining acceptance, a common fate in this field, where regulators are particularly cautious about new drugs. And Merck had already solidified its lead in the DPP-4 market with Januvia whileOnglyza trailed closely behind it. Takeda had hoped that a combination of TAK-875 and Januvia could help regain some lost market territory–but that dream has clearly vanished as well.

| January 27, 2014 | |

| January 22, 2014 | |

| January 17, 2014 | |

| January 14, 2014 | |

| January 10, 2014 |

2013

| December 27, 2013 | ||

| December 25, 2013 | ||

| December 25, 2013 | ||

| December 24, 2013 | ||

| December 20, 2013 | ||

| December 20, 2013 | ||

| December 19, 2013 | ||

| December 10, 2013 | ||

| December 10, 2013 | ||

| December 10, 2013 | ||

| December 10, 2013 | ||

| December 9, 2013 | ||

| December 5, 2013 | ||

| December 4, 2013 | ||

| November 30, 2013 | ||

| November 21, 2013 | ||

| November 19, 2013 | ||

| November 14, 2013 | ||

| November 12, 2013 | ||

| November 12, 2013 | ||

| October 21, 2013 | ||

| October 7, 2013 | ||

| October 2, 2013 | ||

| October 1, 2013 |

| September 26, 2013 | ||

| September 26, 2013 | ||

| September 24, 2013 | ||

| September 20, 2013 | ||

| September 20, 2013 | ||

| September 13, 2013 | ||

| September 13, 2013 | ||

| September 5, 2013 | ||

| September 2, 2013 | ||

| August 27, 2013 | ||

| August 27, 2013 | ||

| August 27, 2013 | ||

| August 22, 2013 | ||

| August 13, 2013 | ||

| August 1, 2013 | ||

| July 31, 2013 | ||

| July 31, 2013 | ||

| July 31, 2013 | ||

| July 30, 2013 | ||

| July 29, 2013 | ||

| July 26, 2013 | ||

| July 19, 2013 | ||

| July 19, 2013 | ||

| July 19, 2013 | ||

| July 18, 2013 | ||

| July 10, 2013 | ||

| July 1, 2013 |

CLIPPED

Takeda isn’t quite in the top 10 among global drugmakers, but the company boasts the 7th-largest pipeline in the industry, according to its presentation at the conference. Yamada noted that 31% of the pipeline assets are in late-stage trials. Millennium is leading development of three late-stage contenders, TAK-700 for prostate cancer, MLN9708 for multiple myeloma and MLN0002 for ulcerative colitis andCrohn’s disease.

In an effort to revive its diabetes franchise, Takeda is in the final stage of development for a first-of-a-kind GPR40 agonist called TAK-875, designed to provide glucose-dependent insulin secretion.

With a rich late-stage pipeline at Takeda, Yamada wants the company to focus on growing its ranks of earlier-stage drug candidates. To do this the company has landed a variety of deals, including the purchase of Intellikine for $310 million to acquire anti-cancer drugs and more recently the acquisition of Envoy Therapeutics last year for $140 million.

Takeda has formed a New Frontier Science group to scout out the hottest research in academia and elsewhere and form collaborations with scientists behind those innovations. At the J.P. Morgan conference, Yamada said, he was attending many meetings with members of the biotech community.

Takeda Pharmaceutical Company Limited (武田薬品工業株式会社 Takeda Yakuhin Kōgyō Kabushiki-gaisha?) is the largest pharmaceutical company in Japan and Asia and a top 15 pharmaceutical company. The company has over 30,000 employees worldwide and achieved $16.2 billion USD in revenue during the 2012 fiscal year.[1] The company is focused on metabolic disorders, gastroenterology, neurology, inflammation, as well asoncology through its independent subsidiary, Millennium: The Takeda Oncology Company.[2] Its headquarters is located in Chuo-ku, Osaka, and it has an office in Nihonbashi, Chuo, Tokyo.[3][4] In January 2012, Fortune Magazine ranked the Takeda Oncology Company as one the 100 best companies to work for in the United States.

Takeda Pharmaceuticals was founded on June 12, 1781 and was incorporated on January 29, 1925.

In 1977, Takeda first entered the U.S. pharmaceutical market by developing a joint venture with Abbott Laboratories called TAP Pharmaceuticals.[5]Through TAP Pharmaceuticals, Takeda and Abbott launched the blockbusters Lupron (leuprolide) in 1985 and Prevacid (lansoprazole) in 1995.

One of the firm’s mainstay drugs is Actos, a compound in the thiazolidinedione class of drugs used in the treatment of type 2 diabetes. Launched in 1999, Actos has become the best-selling diabetes drug in the world with $4 billion USD in sales during the 2008 fiscal year.[6]

In February 2005, Takeda announced its acquisition of San Diego, California-based Syrrx, a company specializing in high-throughput X-ray crystallography, for $270 million.[7]

In February 2008, Takeda acquired the Japanese operations of Amgen and rights to a dozen of the California biotechnology company’s pipeline candidates for the Japanese market.[8]

In March 2008, Takeda and Abbott Laboratories announced plans to conclude their 30-year old joint venture, TAP Pharmaceuticals, that had over $3 billion in sales in its final year. The split resulted in Abbott acquiring U.S. rights to Lupron and the drug’s support staff. On the other hand, Takeda received rights to Prevacid and TAP’s pipeline candidates. The move also increased Takeda’s headcount by 3,000 employees.[9]

In April 2008, Takeda announced that it was acquiring Millennium Pharmaceuticals of Cambridge, Massachusetts, a company specializing in cancerdrug research, for $8.8 billion. The acquisition brought in Velcade, a drug indicated for hematological malignancies, as well as a portfolio of pipeline candidates in the oncology, inflammation, and cardiovascular therapeutic areas. Millennium now operates as an independent subsidiary, serving as the global center of excellence in oncology under its new name: “Millennium: The Takeda Oncology Company.” [10]

In May 2008, the company licensed non-exclusively the RNAi technology platform developed by Alnylam Pharmaceuticals, creating a potentially long-term partnership between the companies.[11]

On May 19, 2011, Takeda Pharmaceutical and Nycomed announced that Takeda will acquire Nycomed for € 9.6 billion. The acquisition was completed by September 30, 2011.[12]

On April 11, 2012, Takeda Pharmaceutical and URL Pharma announced that Takeda will acquire URL Pharma for $800 million. The acquisition is expected to be completed within 60 days.

On 25 May 2012, Takeda announced the purchase of Brazilian pharmaceutical company Multilab by R$ 540 million.[13]

Takeda Midosuji Building, headquarters of Takeda Pharmaceutical Company, inChuo-ku, Osaka, Japan

Takeda operates two primary bases in Japan in Osaka and Tokyo. Its United States subsidiary is based in Deerfield, Illinois, and all Global Operations outside of Japan and U.S. are based in Opfikon (Zurich), Switzerland. The company maintains research & development sites in Osaka and Tsukuba, Japan; San Diego andSan Francisco, United States; Cambridge, United Kingdom; and Singapore.[14]

The company has manufacturing facilities in Japan, China, Indonesia, Italy, and Ireland.[15] Following the Nycomed acquisition, the Takeda manufacturing sites have been extended with facilities in Argentina,Austria,Belgium,Brazil,Denmark, Estonia,Germany,Mexico,Norway and Poland. Takeda has overseas marketing presences in the U.S., UK, France, Italy, Germany, Austria, Switzerland, Spain, China, Taiwan, Philippines, Thailand, Indonesia, and Singapore. It has recently[when?] announced its first foray into Canada, Portugal, Spain, Mexico, and Ireland.[15]

AT INDONESIA

Some of the key products that Takeda produces on behalf of partners include:[16]

AT UK

AT UK

|

|

| Native name | 武田薬品工業株式会社 |

|---|---|

| Type | Public KK |

| Traded as | |

| Industry | Pharmaceuticals |

| Founded | Doshomachi, Osaka, Japan (June 12, 1781) |

| Headquarters | 1-1, Doshomachi Yonchome,Chuo-ku, Osaka, Japan |

| Key people | Yasuchika Hasegawa (President & CEO) |

| Revenue | |

| Operating income | |

| Net income | |

| Total assets | |

| Total equity | |

| Employees | 30,481 (2012) |

| Website | takeda.com (Global website) |

References:

|

|

CMC CENTRE

The Chemistry, Manufacturing and Controls (CMC) Center is a global organization responsible for overall R&D activities ranging from chemical information on development candidates to the processes leading to “manufacturing” of pharmaceutical products.

The main sites are located in Osaka and consist of the following laboratories: the Chemical Development Laboratories in charge of R&D for developing the manufacturing methods of active pharmaceutical ingredients and the manufacturing of drug substances for clinical samples; the Pharmaceutical Technology R&D Laboratories in charge of R&D for dosage forms, manufacturing and packaging, as well as manufacturing of clinical samples; and the Analytical Development Laboratories in charge of R&D for the development of analytical methods and stability studies of clinical samples. In addition, Hikari Bio-Manufacturing Technology Laboratories is located in Hikari (Yamaguchi) and this is where antibody drug substances are manufactured.

As for overseas sites, the Cambridge Biologics CMC Group (Massachusetts) and the Chicago Pharmaceutical Science Group (Illinois) are located in the USA, while the CMC Center Europe is mainly located in Roskilde, Denmark. All research and development activities at Takeda are promoted with the cooperation of these sites.

IDMA best biotech NEW MOLECULAR ENTITY patent award to Glenmark

YEAR 2012-2013 YEAR in Mumbai India

PATENT US 8236315

GLENMARK PHARMACEUTICALS, S.A., SWITZERLAND

INVENTORS

Elias Lazarides, Catherine Woods, Xiaomin Fan, Samuel Hou, Harald Mottl, Stanislas Blein, Martin BertschingerALSO PUBLISHED ASCA2712221A1, CN101932606A,EP2245069A1, US20090232804,WO2009093138A1

|

USPTO, USPTO Assignment, Espacenet, US 8236315

The present disclosure relates generally to humanized antibodies or binding fragments thereof specific for human von Willebrand factor (vWF), methods for their preparation and use, including methods for treating vWF mediated diseases or disorders. The humanized antibodies or binding fragments thereof specific for human vWF may comprise complementarity determining regions (CDRs) from a non-human antibody (e.g., mouse CDRs) and human framework regions.

The present disclosure provides a humanized antibody or binding fragment thereof specific for vWF that comprises a heavy chain variable region sequence as set forth in SEQ ID NO: 19 and a light chain variable region sequence as set forth in SEQ ID NO: 28 ……….. CONT

MR GLEN SALDANHA

MD , CEO GLENMARK

102-B Poonam Chambers, Dr A B Road, Worli, Mumbai 400 018, INDIA

Tel : +91 – 22 – 24944625 / 24974308. Fax : ++91 – 22 – 24957023

email: ppr@idmaindia.com website : www.idma-assn.org

With 11 treatments in Phase I trials, 8 in Phase II, and 13 in Phase III, Bayer has a strong pipeline.

By far the most interest currently, given that the latest reports came out October 21st, is riociguat (BAY 63-2521),

which has had good news from its ongoing Phase III clinical trials of the treatment for pulmonary arterial hypertension, also known as PAH. PAH is a progressive condition that overburdens the heart.

Trials indicate subjects had improved heart function and could better tolerate physical exercise. Patients on riociguat improved their walking distance by 36 meters on average, while those on placebo showed no improvement.

Professor Hossein Ardeschir Ghofrani of University Hospital Giessen, the principal investigator, was quite pleased with the results and explained the value of the measurement. “The six-minute walk distance test is a well-validated clinical measure in patients with PAH, and therefore, the results of the PATENT-1 trial are encouraging. . .These data from the PATENT study suggest that riociguat may be a potential treatment option both for patients who have never been treated for PAH as well as for those who have received prior treatment.”

Hossein A. Ghofrani

Associate Professor of Internal Medicine,

MD (University of Giessen) 1995 Research interests: pulmonary hypertension, ischaemia-reperfusion, experimental therapeutics, clinical trials

http://www.uni-giessen.de/cms/fbz/fb11/forschung/graduierte/mbml/faculty

Although Bayer put forth no sales estimate for the treatment, analysts predicted 2017 sales from riociguat of $480 million.

BAYER PIPELINE AS ON OCT 25 2013

phase 1

| Project | Indication |

|---|---|

| CDK-Inhibitor (BAY 1000394) | Cancer |

| Mesothelin-ADC (BAY 94-9343) | Cancer |

| PSMA Bi TE Antibody (BAY 2010112) | Cancer |

| PI3K-Inhibitor (BAY 1082439) | Cancer |

| FGFR2 Antibody (BAY 1179470) | Cancer |

| HIF-PH (BAY 85-3934) | Anemia |

| Partial Adenosine A1 Agonist(BAY 1067197) | Heart Failure |

| Vasopressin Receptor Antagonist(BAY 86-8050) | Heart Failure |

| sGC Stimulator (BAY 1021189) | Heart Failure |

| S-PRAnt (BAY 1002670) | Symptomatic uterine fibroids |

| BAY 1026153 | Endometriosis |

phase2

| Project | Indication |

|---|---|

| PI3K-Inhibitor (BAY 80-6946) | Cancer |

| Regorafenib | Cancer |

| Refametinib (MEK-Inhibitor) | Cancer |

| Radium-223-Dichloride | Cancer |

| Sorafenib | Additional Indications |

| MR-Antagonist (BAY 94-8862) | Congestive Heart Failure (CHF) |

| MR-Antagonist (BAY 94-8862) | Diabetic Nephopathy |

| Riociguat (sGC Stimulator) | Pulmonary Hypertension |

| Neutrophil Elastase Inhibitor(BAY 85-8501) | Bronchiectasis |

phase 3

| Project | Indication |

|---|---|

| Sorafenib | Breast Cancer |

| Sorafenib | Adjuvant HCC |

| Sorafenib | Adjuvant RCC |

| Regorafenib | HCC 2nd line |

| Rivaroxaban | Major Adverse Cardiac Events |

| Rivaroxaban | CHF and CAD |

| peg rFVIII(BAY 94-9027) | Hemophilia |

| Aflibercept | Myopic choroidal neovascularization (mCNV) |

| Aflibercept | Diabetic Macular Edema (DME) |

| LCS 16 | Contraception |

| Vaginorm | Vulvovaginal atrophy (VVA) |

| Sodium Deoxycholate | Submental fat removal |

| Cipro DPI | Lung infection |

| Tedizolid | Skin and Lung Infections |

| Amikacin Inhale | Gram-negative pneumonia |

Sorafenib tosylate

http://newdrugapprovals.wordpress.com/2013/07/16/nexavar-sorafenib/

TEDIZOLID PHOSPHATE

Leverkusen, October 8, 2013 – Following the recent commercial introduction of five new drugs to address the medical needs of patients with various diseases, Bayer is now accelerating the development of further five promising drug candidates which are currently undergoing phase I and II clinical studies. The company today announced that it plans to progress these five new highly innovative drug candidates in the areas of oncology, cardiology, and women’s health into phase III clinical studies by 2015.

“Our Pharma research and development has done a tremendous job of bringing five new products to the market offering physicians and patients new treatment alternatives for serious diseases”, said Bayer CEO Dr. Marijn Dekkers. “Following our mission statement ‘Science For A Better Life’, the five chosen further drug candidates all have the potential to impact the way diseases are treated for the benefit of patients.”

Bayer CEO Dr. Marijn Dekkers

“Our research and development activities are strongly focused on areas where treatment options are not available today or where true breakthrough innovations are missing”, said Prof. Andreas Busch, member of the Bayer HealthCare Executive Committee and Head of Global Drug Discovery at Bayer HealthCare. “Our drug development pipeline holds a number of promising candidates which we want to bring to patients who need them urgently”, said Kemal Malik, member of the Bayer HealthCare Executive Committee, Chief Medical Officer and Head of Pharmaceutical Development at Bayer HealthCare. “Furthermore we are continuing to expand the range of indications for all our recently launched products Xarelto, Stivarga, Xofigo, Riociguat as well as Eylea and further refine the profile of these drugs in specific patient populations.”

Cl 223Ra Cl

Xofigo

http://newdrugapprovals.wordpress.com/2013/09/21/xofigo-injection-recommended-for-approval-in-eu/

The five mid-stage candidates have been selected for accelerated development based on positive “proof-of-concept” data from early clinical studies. Three of them are development compounds in the area of cardiology or the cardio-renal syndrome: Finerenone (BAY 94-8862) is a next generation oral, non-steroidal Mineralocorticoid Receptor antagonist which blocks the deleterious effects of aldosterone. Currently available steroidal MR antagonists have proven to be effective in reducing cardiovascular mortality in patients with heart failure but have significant side effects that limit their utilization. Finerenone is currently in clinical Phase IIb development for the treatment of worsening chronic heart failure, as well as diabetic nephropathy.

Finerenone (BAY 94-8862)

The second drug candidate in the area of cardiology is an oral soluble guanylate cyclase (sGC) stimulator (BAY 1021189). The start of a Phase IIb study in patients with worsening chronic heart failure is expected later this year.

For the cardio-renal syndrome, a Phase IIb program with the investigational new drug Molidustat (BAY 85-3934) is under initiation in patients with anemia associated with chronic kidney disease and/or end-stage renal disease. Molidustat is a novel inhibitor of hypoxia-inducible factor (HIF) prolyl hydroxylase (PH) which stimulates erythropoietin (EPO) production and the formation of red blood cells. Phase I data have shown that inhibition of HIF-PH by Molidustat results in an increase in endogenous production of EPO.

Molidustat (BAY 85-3934)

In oncology, Copanlisib (BAY 80-6946), a novel, oral phosphatidylinositol-3 kinases (PI3K) inhibitor, was selected for accelerated development. Copanlisib demonstrated a broad anti-tumor spectrum in preclinical tumor models and promising early clinical signals in a Phase I study in patients with follicular lymphoma. A Phase II study in patients with Non-Hodgkin’s lymphoma is currently ongoing.

Bayer has also made good progress in the development of new treatment options for patients with gynecological diseases: sPRM (BAY 1002670) is a novel oral progesterone receptor modulator that holds the promises of long-term treatment of patients with symptomatic uterine fibroids. Based on promising early clinical data the initiation of a Phase III study is planned for mid-2014.

Initiation of further studies with recently launched products

Bayer has successfully launched five new pharmaceutical products, namely Xarelto™, Stivarga™, Xofigo™, Eylea™, and Riociguat, which has very recently been approved in Canada under the trade name Adempas™.

Regorafenib, stivarga

Bayer’s Eylea (aflibercept),

http://newdrugapprovals.wordpress.com/2013/06/01/lucentis-rival-one-step-away-from-nhs-approval/

Xarelto has been approved globally for five indications across seven distinct areas of use, allowing doctors to treat patients in a greater variety of venous and arterial thromboembolic conditions than any other novel oral anticoagulant. The company continues to study the use of Xarelto for the treatment of further cardiovascular diseases. Ongoing clinical Phase III studies include COMPASS and COMMANDER-HF. The COMPASS study will assess the potential use of Xarelto in combination with aspirin, or as a single treatment to prevent major adverse cardiac events (MACE) in nearly 20,000 patients with atherosclerosis related to coronary or peripheral artery disease. The COMMANDER-HF study will evaluate the potential added benefit of Xarelto in combination with single or dual-antiplatelet therapy to help reduce the risk of death, heart attack and stroke in approximately 5,000 patients with chronic heart failure and coronary artery disease, following hospitalization for exacerbation of their heart failure.

In order to answer medically relevant questions for specific patient populations Bayer has initiated a range of additional Xarelto studies in patients with atrial fibrillation (AF) undergoing percutaneous coronary intervention with stent placement (PIONEER-AF-PCI), cardioversion (X-VERT) or an AF ablation procedure (VENTURE-AF).

As an extension to the Xarelto clinical trial programme, a number of real-world studies are designed to observe and further evaluate Xarelto in everyday clinical practice. These include the XAMOS study of more than 17,000 orthopaedic surgery patients, which confirmed the clinical value of oral, once-daily Xarelto in routine clinical practice in adults following orthopaedic surgery of the hip or knee. XANTUS is designed to collate data on real-world protection with Xarelto in over 6,000 adult patients in Europe with non-valvular AF at risk of stroke while XANAP is designed to collate data on real-world protection with Xarelto in over 5,000 adult patients in Europe and Asia with non-valvular AF at risk of stroke. XALIA will generate information from over 4,800 patients treated for an acute DVT with either Xarelto or standard of care.

In the area of oncology, Stivarga has been approved in 42 countries for use against metastatic colorectal cancer that is refractory to standard therapies, and additionally for gastrointestinal stromal tumor (GIST) in the US and Japan. Bayer is now planning to assess Stivarga in earlier stages of colorectal cancer as well as other cancer types. A Phase III trial in patients with colorectal cancer after resection of liver metastases is currently under initiation. Based on early clinical data Bayer has also initiated a Phase III study in liver cancer in patients who have progressed on sorafenib treatment.

Furthermore, the anti-cancer drug Xofigo (radium 223 dichloride) is a first-in-class alpha-pharmaceutical which is designed for use in prostate cancer patients with ‘bone metastases’ (secondary cancers in the bone) to treat the cancer in the bone and to help extend their lives. Xofigo is approved in the US for the treatment of patients with advanced castrate-resistant prostate cancer with symptomatic bone metastases. In addition, the European CHMP recently gave a positive opinion for radium 223 dichloride for the same use. The decision of the European Commission on the approval is expected in the fourth quarter of 2013.

Based on the excellent Phase III results for Xofigo in patients with castration resistant prostate cancer and symptomatic bone metastases Bayer is looking to expand the use of Xofigo to earlier stages of the disease, and plans to initiate a Phase III study in combination with the novel anti-hormonal agent abiraterone. In addition, early stage signal-generating studies in other cancer forms where bone metastases are important causes of morbidity and mortality are planned.

In the area of pulmonary hypertension Adempas (Riociguat) is the first member of a novel class of compounds – so-called ‘soluble guanylate cyclase (sGC) stimulators’ – being investigated as a new and specific approach to treating different types of pulmonary hypertension (PH). Adempas has the potential to overcome a number of limitations of currently approved treatments for pulmonary arterial hypertension (PAH) and addresses the unmet medical need in patients with chronic thromboembolic pulmonary hypertension (CTEPH). It was approved for the treatment of CTEPH in Canada in September 2013, making it the world’s first drug approved in this deadly disease.

Riociguat has already shown promise as a potential treatment option beyond these two PH indications. An early clinical study was conducted in PH-ILD (interstitial lung disease), a disease characterized by lung tissue scarring (fibrosis) or lung inflammation which can lead to pulmonary hypertension, and, based on positive data, the decision was taken to initiate Phase IIb studies in PH-IIP (idiopathic pulmonary fibrosis), a subgroup of PH-ILD. Moreover, scientific evidence was demonstrated in preclinical models that the activity may even go beyond vascular relaxation. To prove the hypothesis Bayer is initiating clinical studies in the indication of systemic sclerosis (SSc), an orphan chronic autoimmune disease of the connective tissue affecting several organs and associated with high morbidity and mortality. If successful, Riociguat has the potential to become the first approved treatment for this devastating disease.

In the area of ophthalmology, Eylea (aflibercept solution for injection) is already approved in Europe and several additional countries for the treatment of neovascular (wet) age-related macular degeneration and for macular edema following central retinal vein occlusion. In September, Bayer HealthCare and Regeneron Pharmaceuticals presented data of the two phase III clinical trials VIVID-DME and VISTA-DME of VEGF Trap-Eye for the treatment of diabetic macular edema (DME) at the annual meeting of the Retina Society in Los Angeles and at the EURetina Congress in Hamburg, Germany. Both trials achieved the primary endpoint of significantly greater improvements in best-corrected visual acuity from baseline compared to laser photocoagulation at 52 weeks. Bayer plans to submit an application for marketing approval for the treatment of DME in Europe in 2013.

About Bayer HealthCare

The Bayer Group is a global enterprise with core competencies in the fields of health care, agriculture and high-tech materials. Bayer HealthCare, a subgroup of Bayer AG with annual sales of EUR 18.6 billion (2012), is one of the world’s leading, innovative companies in the healthcare and medical products industry and is based in Leverkusen, Germany. The company combines the global activities of the Animal Health, Consumer Care, Medical Care and Pharmaceuticals divisions. Bayer HealthCare’s aim is to discover, develop, manufacture and market products that will improve human and animal health worldwide. Bayer HealthCare has a global workforce of 54,900 employees (Dec 31, 2012) and is represented in more than 100 countries. More information at www.healthcare.bayer.com.

Pfizer gets a lot of coverage in the financial papers–even if some of it turns out to be misguided.

For example, Pfizer got the media coverage all drug companies desire on May 4 from Seeking Alpha, http://seekingalpha.com/article/560531-pfizer-alzheimers-drugs-will-carry-stock-to-new-highs-in-2013

a stock market blog that provides free stock market analysis. A piece entitled “Pfizer: Alzheimer’s Drugs Will Carry Stock To New Highs In 2013” had a subheading “strong pipeline.”

Turns out that was too optimistic, as Pfizer’s Alzheimer’s drug–along with Johnson and Johnson’s–both failed to produce. But many stock analysts still hold hope that Pfizer has a new ‘cash cow’ coming down the pipeline.

Daily Finance http://www.dailyfinance.com/2012/09/07/a-peek-at-pfizers-pipeline/

notes that Pfizer currently has 87 drugs in its pipeline. While its true that most are in the early stages, 11 are ready to be reviewed by the FDA.

That number puts it ahead of most of its rivals, with Eli Lilly, a close second, having 63 drugs in Phases 1-3, plus one currently being reviewed. Bristol-Myers Squibb has 46 drugs in development, 7 under review, Merck has 35 drugs in Phase 2 or 3 with two under review, and Johnson and Johnson has 18 drugs that are already in Phase 3 clinical trials or up for FDA approval.

But, of course, as the journal points out, “Quality trumps quantity. . . . One or two blockbusters can be better than several lower-revenue drugs.”

So what does Pfizer have up its sleeve that might begin to fill the very big shoes of Lipitor?

Well, the company has diversified the therapeutic areas under research, with 26% of R&D efforts going toward oncology treatments, 20% to neuroscience and pain, 17% to cardiovascular and metabolic diseases, 14% to inflammation and immunology, 5% to vaccines, and 18% toward ‘other.’

Pfizer has several medicines for diabetes alone coming up, in Phase I and Phase II trials, almost all meant to treat type 2 diabetes.

But, notes Seeking Alpha,http://seekingalpha.com/article/560531-pfizer-alzheimer-s-drugs-will-carry-stock-to-new-highs-in-2013

its blockbuster potential in this area is limited by the existing treatments of Merck and Sanofi. 10% of Sanofi’s total sales come from Lantus,

a diabetes drug useful for both types 1 and 2, and Merck made $1.3 billion off its Januvia

franchise in the first quarter of this year alone.

So hopes are pinned on Pfizer’s tofacitinib, currently under FDA review, as the treatment with the potential to earn $1 billion or more in sales, easing the gaping wound left by Lipitor. Tofacitinib prompts such high hopes because it might possibly treat rheumatoid arthritis, psoriasis, and irritable bowel syndrome. Some analysts have pinned this as the cash cow Pfizer so badly needs to replace treatments lost to the patent cliff.

Tofacitinib

http://seekingalpha.com/article/812981-pfizers-success-with-its-jak-inhibitor

If it gets approved, Tofacitinib would be first treatment for rheumatoid arthritis (RA) in a new class of medicines (known as Jenus kinase, or JAK, inhibitors), and the first JAK inhibitor approved for rheumatoid arthritis.

Tofacitinib showed statistically significant improvement compared to placebo in decreasing the symptoms of RA (as measured by 20% improvement in the American College of Rheumatology scale), in improving physical function (as measured by mean change in Health Assessment Questionnaire-Disability Index), and in leading to remission (as measured by Disease Activity Score 28 ESR).

Joel Kremer, MD, chief of medicine at Albany Medical College in N.Y., after analyzing the data, commented, “Tofacitinib appears to reduce the signs and symptoms of rheumatoid arthritis very quickly. We hope that after carefully considering the benefit/risk equation, this compound will provide an additional valuable treatment option for patients who have experienced inadequate response to prior treatments.”

Pfizer also believes its blood thinner Eliquis, which it is developing with Bristol-Myers Squibb (see below) could be a big money-maker.

apixaban, eliquis