SOURCING IN PHARMA

Recent surge of Covid 19 pandemic in early 2020 elevated the need to supply vaccines and drugs to combat infection, it also raised need for testing kits, preventive kits and gears, ventilators, oxygen, This raised bar of sourcing and movement of materials to assist urgent need of medicaments. Sourcing and outsourcing played a key role in procurement of raw materials, manufacture and transfer to respective end user or export.

Vaccine manufacture needed rawmaterials , oxygen was imported. This is enough to exhibit importance of sourcing in pharma.

Three factors are central to the sourcing process, and these are:

- Cost structure

- Profit margins

- Competitiveness

Active Pharmaceutical Ingredients (APIs) is a substance used in a finished pharmaceutical dosage form, intended to cure diseases, or to assist directly in the diagnosis, cure, treatment or prevention of disease, or to have direct effect in restoring, correcting or modifying physiological functions in human beings or animals. It impacts API, finished formulations, biopharma ie vaccines and biopharmaceuticals, equipment and machines and testing kits too

The fundamental rule is never put your eggs in one basket,

because it can prove risky for you. Many companies had to face serious fall-out because of its decision to opt for single sourcing.

It had to shut down assembly lines and incur a huge loss. Let’s go through some points where a business entity has decided to opt for single sourcing for its products.

- There is a dependency between the supplier and buyer that can turn risky at a future date.

- If the supply is interrupted for any reason, the business will have to face lots of difficulties as it was a single-sourcing option.

- Absence of healthy competition results in lack of interest because there is nothing to keep the supplier on its toes.

- During high demand, the buyer can face difficulty if there is only one source from where he can procure goods.

- If a business entity persists with the policy of single sourcing, other suppliers lose interest in it and stop trying to compete for further negotiations.

- If the single source faces a sudden problem or event, the buyer will also have to deal with serious repercussions.

A drug is usually composed of several components. The API is the primary ingredient. Other ingredients are commonly known as inactive excipients. Sometimes a drug can contain combination of APIs and its effect on a patient depends on the dosage prescribed and can vary in a range from person to person. In mixed therapies, two or more than two active ingredients are used to treat different diseases in different ways.

Pharmaceutical manufacturing occurs in two general steps. In the first step, manufacturers convert raw materials into APIs. The second step involves creating the final formulation by mixing APIs and excipients into tablets, capsules injections, creams, and so on and finally packaging the drug for the end-users.

Manufacturers either sell APIs in the open market (also known as the merchant market) or use them as inputs to make their final formulations.

The global API market is extremely competitive with a number of large and small manufacturers. Firms that engage in API manufacturing generally specialize and target their manufacturing based on a combination of the firm’s in-house skills, talent, manpower, innovations and market opportunities. Catalysed by lower costs, API manufacturing has gradually been shifting from the historical leaders in Western countries to manufacturers based in India and China.

API sourcing

Financial and efficiency incentives are driving the pharma industry to outsource an increasingly large share of their API production, whether it is for generic, discovery or innovative API.

The rising costs and regulatory pressure in developed markets are forcing many global pharmaceutical companies to reduce their internal capacities in research and development, and manufacturing, and turn to contract manufacturing and research services and outsourcing of research and clinical trials to developing countries.

These strategies help multinational companies to reduce costs, increase development capacity, and focus on their core profit making activities, such as drug discoveries and marketing, rather than on manufacturing.

India is fast emerging as a preferred destination for such multinationals seeking efficiencies of cost and time in all areas of cycle of the product, API or Generics.

Advantages of API sourcing

As the global demand for pharmaceutical solutions is growing, more and more drug companies are feeling the pressure to bring drugs to the market faster and more cost effectively.

API sourcing is often a way to fast track these opportunities by exploring and leveraging the skills, capacity, knowledge and experiences of the API manufacturers and suppliers.

Perhaps the most far-reaching trend we have witnessed in the market is the move by pharmaceutical companies to speed up the process by moving away from manufacturing their own APIs and a move to outsourcing their API manufacture to third-party expert producers.

Manufacturing updates & trends

The newest generation of APIs being developed are extremely complex, these includesteroactive complex, peptides, high potency APIs, oligonucleotides, and sterile APIs. This means that the R&D and certification processes themselves have also become longer and more complicated.

This needs expertise, skill, knowledge, facilities and skilled manpower.

A multitude of small producers, specialising in manufacturing niche APIs has led to more intense competition despite the growing market.

Advancements in API manufacturing and growth of biopharmaceutical sector are expected to be the key factors driving the market.

Based on the manufacturer type, the market is categorised into captive(self use) and merchant APIs.

Captive segment held the largest share owing to intensive capitalisation of major key companies in development of high-end manufacturing facilities and availability of raw materials.

Merchant API segment is expected to be the fastest-growing segment owing to factors, such as rising demand for biopharmaceuticals and high cost of in-house manufacturing of these molecules. In addition, since the captive production of APIs is expensive, companies have started opting for outsourcing.

Based on type, the market is segmented into generic, discovery and innovative APIs. Innovative drugs segment led the overall market due to increased R&D initiatives for novel drug development and favourable government regulations. Rising number of new entrants in this segment is also expected to propel the market growth. Generic drug segment is estimated to be the second fastest-growing segment due to factors, such as patent expiry of branded drugs and lower cost. The segment is likely to witness growth in the developing regions like Brazil and India due to unmet clinical needs and high acceptance levels for OTC drugs.

When selecting an API partner it is important to choose a supplier that has the reliabilty, competencies, scalability and dynamics to meet the increasing demand from authorities throughout the collaboration process.

Demand for higher quality, lower cost products combined with growing demand for scrutiny throughout the supply chain is reshaping the API industry.

Another important trend in the global API market is increasing focus on complex formulations in generics development since chronic diseases require complex treatments using complex molecules.

Many of the medications used to treat several diseases have become commodities, and the same can be said about the respective APIs. To help offset the commoditization of these drugs; leading API manufacturers are pivoting to highly complex technologies such as peptides, oligonucleotides and sterile APIs.

As the volume of API production increases, unfortunately the number of major issues with quality and compliance also increased. This led to an increase in regulatory demands primarily from the regulated markets.

The API market is highly competitive and consists of several major players; thus, indicating a fragmented market scenario. The API market has several manufacturers from China and India holding a dominant market position, due to their large manufacturing footprint. In Europe, Italy, Germany, and the United Kingdom are the key regions for API trade, due to the presence of a well-developed pharmaceutical and life sciences industry.

A majority of the APIs produced are used for captive production. Some companies emerged as contract manufacturers with a diversified client base. Further, with increasing technological advancements and product innovation, mid-size and small-scale companies are increasing their market presence, by introducing new ingredients with competitive prices.

Why Is Sourcing Important? What is sourcing in supply chain? Done well, sourcing allows companies to establish consistent supply chains. This keeps your shelves stocked and customers happy.

Strategic planning in the sourcing process is central to cost structure, profit margins, and competitiveness for businesses of all sizes.

The process of sourcing products or services is the first step in the supply chain. It’s about finding the balance between the quality of products and raw materials you need and the affordability. The less you spend, the more you’ll make. However, poor-quality goods won’t do the job.

Sourcing means finding the right suppliers that provide the quality you need at a price point that gives you the margin you need. A strategic sourcing process can be a difference-maker when it comes to your bottom line.

To make things easier, let’s break down everything involved with sourcing – from finding products, to finding the best people to buy those products from, to the delivery types involved from sourced supplier to customer. Creating a seamless pipeline to procure these products and bring them to consumers will keep your sales process functioning efficiently.

Sourcing of APIs or intermediates has been a subject of interest in the pharmaceutical industry for decades now. This is a look at the subject from the perspective of an API supplier.

The importance of sourcing ebbs and flows over time depending on pressures from the business and political environments. Currently, the most important of those pressures are:

1.The looming “patent cliff” and resulting loss in revenue for branded pharmaceutical businesses.

2.Lower than peak flow of new drugs to offset revenue lost due to patent expirations.

3.Increasing complexity of the molecules that are coming though the pipeline.

4.Exploding government obligations to fund healthcare costs and active efforts to control them.

API sourcing is being used in several ways to relieve these pressures. The core competencies of pharma companies are generally considered to be

(a) drug discovery & development and

(b) sales & marketing.

This creates an interesting dichotomy where manufacturing isn’t considered critically important but supply is a critical success factor. API sourcing is used to solve the supply problem and frees companies to invest capital in drug discovery, development and marketing.

The three most important decision-making criteria for API sourcing are typically:

1.Quality

2.Security of Supply

3.Cost

The first two factors are frequently taken as a given, and cost is the focus for decision-making — until one of the first two goes wrong! At present the API supply market is experiencing an excess of capacity relative to demand. The intense competition to fill available capacity results in deals being struck that are, in the long-term, economically questionable for the API supplier. The productive result of this pressure on margins is that API companies are forced into a relentless quest for manufacturing cost improvements. The less productive outcome for some API companies and their customers is that the quest for cost improvements creeps into activities that compromise quality and security of supply.

Every pharma company has a duty to return a profit to its shareholders. Every rupee saved in sourcing costs is transferred to the bottom line. Driving down the cost of sourced APIs is a responsibility. There comes a point in the cost reduction curve where incremental cost saving must be balanced with the profit margin generated by the product manufactured using the sourced APIs. Particularly for branded pharmaceutical companies, the cost saving can be dwarfed by the margins on lost sales if the security of API supply or quality is compromised. Generic pharma companies have the most delicate balancing act to manage between minimizing cost and protecting profits by virtue of their slim profit margins.

API Sourcing and API suppliers can make other contributions in addition to cost containment. Particularly important is the potential of API sourcing to improve speed to market. In the early days of the outsourcing trend, the decision of what to outsource was based on what in-house manufacturing could not or did not want to make. Now the decision is often based on what in-house manufacturing cannot make fast enough or what investment in manufacturing capability doesn’t add incremental value to the pharma firm. API supply is frequently on the critical path of the drug development schedule. The capability may exist in-house but it might be faster to outsource manufacturing. The capital may exist to fund the creation of manufacturing capability, but the pharma firm is increasingly likely to decide that capital is better deployed in discovery and development of new drugs or the acquisition of new drug development projects. The increasing complexity of synthetic molecules being developed as new drugs increases the range of chemical technologies required to manufacture the product. It’s not viable for one company to build in-house capabilities for the full range of technologies that might be required to make the next new drugs to emerge from its pipeline.

An important strategic sourcing decision is how many suppliers to qualify for a particular material. Qualifying larger numbers of suppliers increases leverage in price negotiations and in theory maximizes security of supply. Having multiple sources approved and buying small amounts from each (or none from some) can lend an opportunistic element to the relationships, which can lead to unpleasant surprises for either the pharma or API company.

Different pharma companies adopt different approaches that fall somewhere on the philosophical continuum of getting married and building a harem. “Marriage” is somewhat out of fashion nowadays. However, it is generally accepted to be a firmer platform for a healthy relationship than the other extreme. In any case, “divorce” is legal and culturally accepted in most jurisdictions.

One trend where marriage is becoming more popular between pharma companies and API suppliers is the sale of underutilized pharma facilities to API companies. These transactions are typically accompanied by a supply contract for one or more materials that the pharma company still needs from the plant but not in sufficient volumes to operate it efficiently. The attraction for the API company acquiring the plant is generally the access to capacity or new production capability at a lower cost than building it from scratch. These deals can be a match made in heaven if the API company has pipeline products with launches pending and a need for incremental capacity to manufacture them.

Sometimes these deals seem to be motivated by a belief that the idle capacity can quickly be filled by new business that wasn’t on the API company’s books before the deal. Deals founded on that value proposition are probably headed for divorce. Nobody wins if the API company cannot rapidly increase the plant utilization after taking it off the pharma company’s hands. The API company is drained of funds feeding an underperforming asset and the pharma company risks losing supply of the products that were part of the supply agreement.

This may be what happened to the Merck/Cherokee deal. In 2008 Merck sold its plant in Riverside, PA to Cherokee, but by September 2010 announced that it would re-acquire the facility. Pfizer and Hovione struck a deal also in 2008 to transfer a plant in Cork, Ireland. That plant is still owned and operated by Hovione and hopefully for them they have a pipeline of pending launches to increase and maintain capacity utilization sufficiently high enough to generate operating profits.

The question of how much capacity utilization is optimal is a very important one. It’s also a very difficult one to answer with specific percentages. A very rough estimate is that when utilization exceeds 75% flexibility starts to suffer and when utilization falls below 60% it becomes a challenge to make an operating profit. These percentages are dependent upon a large number of variables, including the number of products manufactured, complexity of the manufacturing processes and predictability of demand. What seems certain however is that the range between choking a plant and losing money is a tight one.

It’s a very challenging business and political environment for the pharmaceutical and API industries today. Those pharma companies with the strongest relationships with their suppliers and those API companies with the strongest relationships with their customers are the companies most likely to survive and thrive.

The flow of new drugs from the pipeline is not consistent from year to year. That’s the nature of R&D. It’s a wasteful use of capital to invest in the capacity and capabilities to accommodate the peaks in demand from the pipeline while leaving it to lie idle during the less productive periods in R&D. Outsourcing the peaks frees up capital for more productive uses. It can also reduce cost, because API companies are better able to come close to level loading their capacity and minimizing overheads per unit.

I should note that there’s an important contrast between API outsourcing and Clinical outsourcing. API sourcing is important before NDA approval and afterwards. Both API outsourcing and Clinical outsourcing may be necessary in order to meet aggressive schedules for NDA flings. The API Sourcing decisions made early in the development of the drug have long-term implications after the launch. The pharma developer is somewhat locked into the suppliers used in the NDA preparation phase. It’s a time-consuming process to qualify a new supplier and obtain approval for a supplemental filing requesting FDA approval to use the new supplier.

- Know the background. As a rule of the thumb, a prerequisite to get high quality products is to conduct a thorough background check of your supplier. …

- Quality. Another important factor while choosing an API supplier is quality. …

- Guarantee and Responsibility. …

- Cost Effective and Efficient

What criteria should drug manufacturers consider when choosing API sourcing partners?

Generally speaking, manufacturers need to think about the long-term stability of their partner. Can they offer sustained supply of a high-quality product at a competitive price and is their service flexible enough to meet your requirements?

Quality is one of the most important factors when sourcing APIs. Drug manufacturers should be looking for partners with strong cGMP compliance records. Pricing is also important, however it’s vital to strike the right balance, namely getting the highest quality for the best price. The cheapest price is not always the most cost-effective option as non-compliant product can be costly further down the line. As such, manufacturers should prioritize other criteria ahead of the initial costs.

Companies should also consider how important the project is to their API partner and how responsive they are during the inquiry stage. This will give an indication of the level of service they can expect during drug product development and commercialization process.

Reduce supply chain cost and risk with API sourcing from CRO/CDMO

Secure your supply chain, and them take the complexity out of API sourcing. They do it all to reduce the cost and risk of getting high-value active pharmaceutical ingredient to your doorstep, from connecting you with the right strategic API manufacturer to managing logistics and regulatory requirements.

More than an API sourcing database, also have an extensive network of prequalified and geographically distributed API manufacturers that has supported very much deliveries over the severalyears. And, with in-house CDMO capability, they can take your project all the way from R&D through commercialization.

What is product sourcing?

Simply put, product sourcing is finding the products you want to sell in your store, buying them from a supplier, and then reselling them. If you’re a API/Intermediates manufacturer, trader or both, formulator/trader, Biopharma manufacturer, trader also Raw material/ Fine chemical/ catalyst/solvent manufacturer trader— then product sourcing is the linchpin of your business.

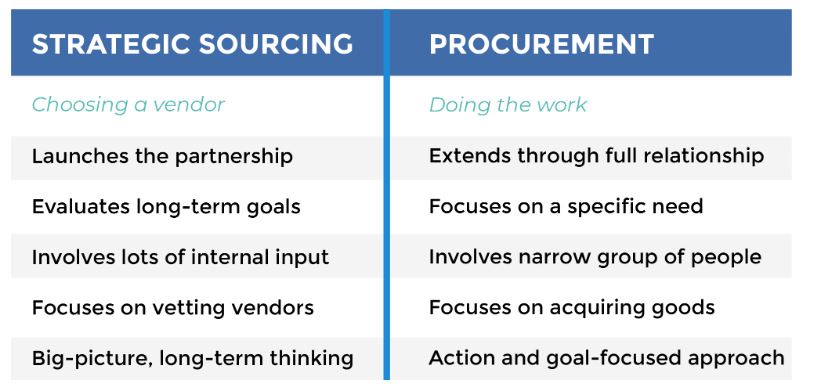

When defining what is sourcing in procurement, they two go hand-in-hand. Before you can procure goods, you’ve got to find the suppliers and vet them out. Connecting with the right suppliers is crucial. If you make mistakes in the sourcing process, it can be difficult – and costly – to backtrack.

Simply put, sourcing is the process of selecting suppliers to provide the goods and services you need to run your business. It may sound uncomplicated, but the process can be complex.

Sourcing involves the following:

- Finding quality sources of goods and services

- Negotiating contracts

- Establishing payment terms

- Market research

- Testing for quality

- Considering outsourcing for goods

- Establishing standards

Sourcing of active pharmaceutical ingredients (APIs) often boils down to ones of economy and purity. Finding the right supplier for your pharmaceutical intermediates and ingredients will make or break your business. Stress is laid on fact that Importance of defining those attributes that impact final product quality to ensure pharma companies find the best ingredient suppliers.

Where to find wholesale product suppliers

Finding the right supplier for your business can be a challenge. The number of suppliers worldwide boggles the mind. And for retailers, there is no single supplier who can provide every single product you’ll need to stock your shelves and meet the needs and wants of consumers.

You will also need to meet your own business needs, whether it’s managing a small business, an online store, or even an online marketplace. It makes sense then, when looking for multiple product suppliers, to check multiple avenues to source those suppliers and products.

Online

It seems that these days, everything starts online. Product sourcing is no exception. When looking online for places to source products for your retail business, there are two options:

- Supplier websites

- Online supplier platforms

While any business worth its salt these days has an online presence, it’s time-consuming and utterly laborious to try and find the right product for your business simply by searching websites. A single product search can turn up thousands of results.

Trade shows

While trade show attendance has been on the decline in recent years, they remain a viable and important source for new product research and acquisition for buyers. Trade shows allow buyers the opportunity for immediate information, seeing the product firsthand, and creating a relationship with suppliers. Trade shows also provide retail buyers with the opportunity to get a heads up on the latest trends, so they can be sure they’re stocking their shelves with the hot products of the present and future.

As the pharmaceutical industry becomes more competitive and processes more rigorous, manufacturers are hard pressed to manage a complex network of raw material suppliers including for pharmaceutical ingredients. For example, China’s pharmaceutical industry alone needs more than 2,000 types of raw materials and intermediates to meet its market demand each year.

During early formulation development in a pharma company think tank team, many pharmaceutical companies use single-sourced active APIs and typically only a small number of API batches. However, ICH Q8(R2)1 indicates that, “at a minimum, those aspects of drug substances that are critical to product quality should be determined and control strategies justified”.

When we talk about pharmaceutical ingredients, it usually involves the following components: pharmaceutical intermediates and active pharmaceutical ingredients (APIs). For the layman, pharmaceutical intermediates are chemical compounds that form the building blocks used to produce APIs, while APIs are the substances used in the manufacture of drug products.

Additionally, APIs are often being developed in parallel to the drug products and consequently their critical quality attributes (CQAs) can change with time.

Unfortunately, there is often too much focus on the chemical purity of the API; forgetting that changes in particle size, shape and bulk density can be equally important to the resultant drug product.

The nature of an API can also be impacted by polymorphism; for example, orthorhombic paracetamol shows improved compression behaviour compared to the monoclinic form.2

Here are some key considerations you need to think about when sourcing for materials for your business:

1. Complex regulations. The pharmaceutical supply chain is a complex process. There are stringent manufacturing processes to abide by and intricate regulatory requirements to be familiar with in each respective market you are intending to enter.

2. Dynamic market. The constantly changing market and pricing trends and the rising number of specialized drugs available in the market today have also resulted in the increase in the complexity of these compounds and raw materials used to develop new drugs.

3. Consumer safety. As these ingredients are used in a highly regulated market, any alteration to the quality of raw materials or any single change can affect the final product’s quality and consumer safety. Any mishap at this stage could prove costly for your business.

4. Disruption to supply chain. Despite the industry being a highly regulated one, untoward accidents do occur. Whether it is disruption to the supply of intermediates and APIs following natural disasters or contamination of raw materials, often, the entire industry, from manufacturers right up to consumers, is affected.

5. Environment conscious and transparency. With consumers becoming more conscious of the choices available in the market, manufacturers are seeking out suppliers with credible environment-conscious processes, good manufacturing practices and eco-friendly products. For manufacturers looking to source raw materials from suppliers in emerging markets, a major challenge is to ensure supply chain transparency.

6. Choosing a certified source. Manufacturers must seek out suppliers that have in place fully compliant audit and process controls throughout their supply chain. These suppliers must, for example, can readily share data about their manufacturing procedures, technical capabilities and quality control measures taken.

Leane, et al.3 recently developed a four‑box model for drug products, termed the manufacturing classification system (MCS), for oral solid dosage forms.

MCS classifies products according to their manufacturing processes;

ie, direct compression (DC – MCS 1),

dry granulation (DG – MCS 2),

wet granulation (WG – MCS 3) and

other technologies (MCS 4).

DC is cheaper, faster and much less complicated than DG or WG; however, DC is also likely to be the process that is most reliant on the initial API particle properties. The API mean particle size and distribution, together with particle shape, are particularly critical for DC as there are no additional processing steps to mitigate those unfavourable API properties.

The dosage strength and API loading are important considerations.

At low drug doses (ie, ≤1mg) or drug loadings (<2.0 percent) DC strategies can be challenging, particularly from the perspective of blend and content uniformity.3 As such, it is important to understand the consistency of physical attributes of the API as there can be large batch-to-batch variability.4 Some API physical properties can also change with time. Freshly milled metformin HCl contains appreciable levels of surface crystal defects, which are not present in aged samples. These in turn can cause differences in flowability of DC powder blends during drug product processing.5 Many companies often introduce “quarantine” periods post-milling or micronising to address such issues.6

Unfortunately, those factors that influence API particle size and shape are not well understood and can be influenced by reactor size, shape, agitation speed and dryer type and configurations. They can also be vulnerable to scale up following the initial transfer into production.7,8

In parallel, additional product demand and/or the need for supply chain flexibility often drives companies to assess dual-sourcing of their API.

Ferreira, et al.9 recently highlighted an issue where a dryer at a second API site produced “denser, less porous material that leads to processability issues” in the drug product.

Lastly, as the product enters the latter stages of its product lifecycle there can be economic considerations that underpin outsourcing the manufacture of the API and/or drug product to a third-party vendor. Here, the situation is often exacerbated as “institutional knowledge” underpinning the processing rationale for the product can typically be lost. Additionally, none of the major pharmacopoeias address physical properties as part of their API monographs. As such, it is not uncommon to encounter issues with the product/ process that can be attributed to subtle changes in the API affecting the drug product.

Chan10 reported capping of metformin DC tablets arising from the introduction of a second source of API, which was attributed to different particle morphologies, ie, acicular versus plates. These potential issues highlight that the transfer and/or buyer specifications for second site sourcing of the API needs to focus on more than cost and chemical criteria; it should also encompass pharmacopoeial monographs and physical properties.

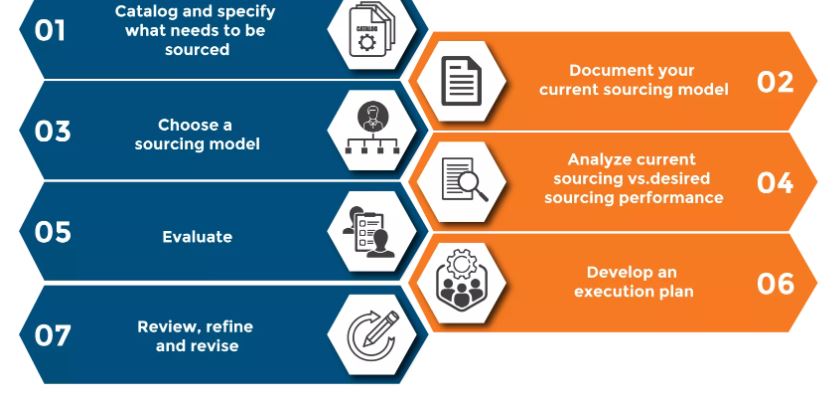

Six steps to successful product sourcing

Sourcing new products can seem overwhelming — it’s not as simple as just finding a great product and putting it in your stores. But there are steps that retailers can take to make the process flow smoothly.

1. Research your product

First and foremost, retailers need to understand the product. Market research is essential to success; sourcing products without the necessary research is asking for failure. The research retailers need in-hand should be well-rounded. This can include:

- Store data. What are the numbers telling you from specific stores? Is there enough interest to drive sales and growth in your retail stores overall? Or would certain products work better for certain stores?

- Consumer demand. What are your consumers asking for? What are they talking about on social media? What are their concerns in surveys? What kind of feedback are you getting through different channels? What topics engage them most? And, linking back to store data, how does what they are saying actually compare to what they are purchasing?

- Trends. What’s trending in the product category, and which companies seem to be addressing these trends? Are these trends crossing over into any other categories?

With this information in hand, buyers can make more informed decisions when it comes time to initiate contact with suppliers. The more a buyer knows about the product he or she wants, the better the result will be.

2. Contact any potential suppliers

Before contacting suppliers, know exactly what it is you, as the buyer, need. Yes, part of this is doing research on the product, as mentioned above. But the other part of it is knowing what you want out of this initial contact with the supplier. Are you looking for information? For samples? Specific products? Knowing that, and being upfront about your needs, will help the process go smoothly.

This step is also where buyers put their contacts from trade shows to use, reaching out to suppliers they’ve met or been in contact with. It’s also a time when they can engage on portal platforms streamlines the process so buyers can research products and easily reach out to suppliers all in one spot.

3. Ask for samples

Would you test drive a car without buying it? No. As a retail buyer, you’re not going to put a product in your store without sampling it. When contacting suppliers, part of the ask should be for samples so you can get feedback from team members, view the product up close and personal, and see how the supplier handles this first transaction before you make the decision on whether to include it in your product mix. Asking for samples is an important part of your sourcing strategy and a good way to test the quality of products.

4. Choose supplier to trial-run an order

Once a retail buyer finds a product that shows potential, order a trial-run for that product. This can mean the buyer asks for a certain number of units to be trialed across a retail chain, or it can mean a product is being tested in only certain stores. A buyer may choose to only trial certain products from the supplier’s overall lineup, rather than the lineup in its entirety.

Buyers should set parameters and key performance indicators around the trial run, including how long the trial will run, sales ratios, and consumer feedback, for example.

5. Evaluate supplier

Whether or not a buyer chooses to move forward with a supplier and form a more long-term relationship depends heavily on how the supplier performs during a trial run. Having the parameters mentioned above will help retail buyers better evaluate suppliers when the trial run ends.

Did the product meet the expected goals?

Did it overperform or underperform?

How was it received in the stores?

In addition to these questions, retail buyers need to ask questions about the relationship with the supplier.

Were they timely and clear in their communications?

Did shipments arrive on time and with the proper products and counts?

Where the products intact when they arrived at the store?

Was the quoted cost on point?

These details can make or break a buyer-supplier relationship. And if a buyer chooses not to pursue a relationship with a supplier, honest, constructive feedback can be helpful to understand why the relationship isn’t moving forward.

6. Keep other supplier options!

Businesses merge, or disband completely, supplies can be difficult to get, or sometimes product quality goes down. These things are to be expected from suppliers in the wide world of online portals, where trends and products can change as often as the wind. And when a consumer expects to always see a product on the shelf and suddenly isn’t, it can be a huge blow, shaking consumer trust in the retailer.

It is essential, then, for retailers to keep their supplier options open. Having more than one supplier for a product ensures that not only is the retailer getting what they need, but consumers are as well.

Benefits of having multiple sources for your products

When sourcing products, retailers don’t want to be at the mercy of a single supplier dictating the terms. Retailers are most concerned with getting the products, their consumers want, on the shelf, and to do that may mean having more than one supplier providing certain products.

And that’s not necessarily a bad thing. Think about it. A multiple-supplier situation can provide:

- Better prices. When more than one supplier is in the mix, there is the opportunity to bring costs down on products.

- Insurance for supplies. If one supplier has an issue getting the necessary parts or ingredients for their product, it can cause a trickle-down effect of product delays, increased logistics costs, or more. But with more than one supplier on a product to pick up the slack, retailers should never, then, be without that product.

- Quality control. When there is more than one supplier for a product source, retailers can easily and quickly compare the quality of the two (or more) products, to ensure that both are still meeting the specs set forth from the beginning.

Cost Management

Strategic sourcing provides benefits for both buyers and suppliers. Buyers can typically negotiate lower unit pricing for high-volume purchasing. This reduces the costs of goods and keeps retail prices competitive. Suppliers benefit because they have a consistent outlet for their goods which makes planning and cash flow more dependable.

Stability

When you find the right source for your products, it truly becomes a partnership. Both businesses rely on each other to keep the supply chain intact. Developing a close relationship can lead to higher quality (and efficiency) as suppliers and customers work together to identify and minimize the root causes of any defects that hurt both buyer and seller.

Managing Risk

Besides identifying and solving problems, a strong relationship built of trust can help mitigate risk. When both parties know they can depend on each other, it opens the door to honest conversation. For example, if one party is having temporary cash flow concerns, it can be discussed openly. This lowers the risk for both parties.

How to Conduct Sourcing

If companies handle the sourcing themselves, there’s no shortcut. Selecting a supplier requires proper research and strategy.

Selecting a Supplier

Selecting a supplier as the source for your goods means investing the time and effort to get to know them and ask the tough questions. After all, it’s the reputation of the business that’s at stake. Companies need to do business with the suppliers that will ensure their products will deliver the best results.

Here are some characteristics to look for when choosing a supplier:

- Years of experience

- Flexibility in changed order times

- Wide range of available products and/or services

- Negotiable prices

- Customer reviews

- Prompt delivery times

- Accommodating customer service

- Financial stability

It’s important to remember that when you’re choosing a vendor, you’re choosing a business partner. This needs to be someone you can trust and someone you can rely on now and in the future. Vendors make a monumental impact on your business, so choose wisely.

Securing a Supplier

If you can visit a supplier in person, your chances of securing that vendor grow exponentially. Whether that’s a possibility or not, here are a few of the critical steps to consider when researching and securing a supplier:

DO YOUR RESEARCH

Do your homework. Start by doing online searches of the supplier’s reputation. You can check the portals in areas where they do business, and online search engines for customer complaints. These can provide important clues and provide areas to probe.

Checking vendor social media accounts can be enlightening. Customers aren’t shy about leaving negative comments online. Be sure to verify registrations, business licenses, and any required certifications. There are a lot of shady operators out there and you want to make sure you won’t get burned.

You need to fully vet any supplier and verify their credibility. Once you have a strategy in place, you can be particular about which suppliers meet your needs and those that won’t.

NEGOTIATE A FAIR DEAL

You need to strike a deal at a fair price that allows you to make the kind of profit you need. Everybody, however, deserves to get a fair deal and make money. You may find that the supplier you really want to do business with is unable to meet your price point. If that’s the case, you’ll need to make a decision on whether you can accept their price or need to find other sources.

Negotiation means more than just price. Payment terms, guaranteed delivery dates, and volume discounts are all part of the discussion. For example, some suppliers will have minimum order quantities (MOQs). Do they align with your needs?

DETERMINE PAYMENT TERMS

Everyone wants to get paid for the work they do or the items they supply. How and when you will pay for the goods to be supplied can make a difference to the cash flow of both companies. There are plenty of examples where two sides strike a deal on everything else, but get hung up on lines of credit or payment terms. Often, you can get better deal points if you guarantee payments within shorter time periods.

Before getting to the numbers, start by establishing good communication and take time to understand a supplier’s business. Make sure they know your relationship will be mutually beneficial to both parties, and be honest about what you expect from the relationship.

Don’t be afraid to ask for better terms than what’s offered. For example, if vendors expect payment in 30 days, you can certainly ask to extend credit for 60 or 90 days. You may not get it, but you might! Or, maybe you’ll end up at 45 days which gives you extra time to pay.

Regardless of where you wind up, think carefully about what you want before you sign off on payment terms. You’ll live with the consequences. It’s always better to have the discussion upfront and be transparent about what you plan to do rather than have to go back to a supplier later and ask for changes.

SPECIFY DELIVERY EXPECTATIONS

The importance of a strong supplier-to-business relationship applies to delivery times as well. Depending on your business structure and needs, there are various options. In negotiating an agreement, discuss your needs fully. You may find the supplier is unable to meet your needs. You may also be able to negotiate better pricing or terms by adapting your delivery expectations to work the way the supplier prefers. If you have the flexibility in your supply chain or timeline, you may be able to conclude a better deal.

Managing your inventory effectively helps reduce your holding costs and tying up capital that could be used elsewhere in your business. Whether you choose continuous replenishment, just in time inventory, or on-demand delivery, all require the cooperation of reliable businesses and suppliers.

Supplier Delivery Models

CONTINUOUS REPLENISHMENT MODEL

In the continuous replenishment model, suppliers make deliveries off a predetermined schedule, often in short periods, based on a company’s inventory data and/or real-time demand. When companies employ continuous replenishment, they encourage reduced inventory levels because they’re ordering in small batches, rather than large batches that are more costly and reduce supplier’s flexibility.

Depending on the supplier, more frequent but consistent deliveries may be preferable. For others, they may be more costly and can increase the price you pay.

JUST IN TIME DELIVERY MODEL

Under a just-in-time delivery model, companies receive supplies on an as-needed basis. In doing so, they reduce inventory levels and costs because just in time delivers only what is needed to increase efficiency and decrease excess waste. With the help of inventory management software, you can better predict inventory demand with forecasting tools to have the right amount of goods.

ON-DEMAND DELIVERY MODEL

In an on-demand delivery model, suppliers deliver goods when demanded by the customer. This gives you the flexibility to wait to take delivery – and trigger payment – until your stock reaches the level where it’s time to reorder.

In this model, it’s especially to choose a supplier who has plenty of products and can be flexible when order times change rapidly. If a company demands it, the supplier must be ready and on time with prompt delivery.

Create a Contract

Once you’ve negotiated the terms, it’s time to draw up a contract. Don’t skimp on an attorney. If you make a mistake or leave it up to the supplier, you may limit your recourse should anything go wrong.

Oral agreements or invoices leave room for error. While they may have some enforceability, it may be expensive and time-consuming to prove if you ever need to take legal action.

Write up a written contract that includes all parties involved, establish payment terms, and commit to any important details, such as timely delivery. A standard contract should cover what’s expected and what happens when one party fails to live up to the agreement.

A vendor contract should cover the following:

- Details of the work the supplier agrees to provide

- The quality of the supplied goods or provided services

- Length of the contract term

- Payment terms

- Indemnity, in the event of loss arising from negligence

- What actions can be taken in case of a breach

A contract is only legally enforceable after the customer and supplier both sign it demonstrating an agreement to live up to the contract’s terms and conditions. Besides legal reasons, it’s also important to establish a relationship built upon mutual expectations.

Typically, the customer includes a statement within the agreement that describes the quality and quantity of goods. Payments made to the supplier are based on the successful fulfillment of this statement.

Outsourcing

Some companies decide they would rather give an outside party the responsibility to choose goods and services instead of doing it themselves. Outsourcing occurs when a company purchases goods and/or services made in-house from an outside supplier. Here are some sourcing examples of why some companies may choose to outsource suppliers for the following reasons:

- If an unexpected increase in demand occurs

- Equipment breaks down

- Lack of plant capacity

- Desire to test the products somewhere else

Many companies outsource the process so they can focus their attention on other areas. This allows them to stay on task with what they do well. They stay focused on their core competencies and let suppliers do what they do best.

Common Questions About Sourcing

Here are the answers to a few common questions when you’re getting started with sourcing.

What’s a good way to find quality suppliers in the sourcing process?

There are several ways to start the sourcing process Some companies will look first to companies that have good reputations in their particular industry and see how they use as suppliers. They also solicit referrals from others in the business. Check industry publications, industry trade organizations, and trade shows for sources.

You can usually count on the industry-leading suppliers to be tried-and-true, but you may also be paying for a name. Regardless of who you source, do your due diligence to make sure they are who they say they are.

And, remember the saying: if it seems to be too good to be true, it probably is.

Should I ask for references?

Yes. You can learn a lot about companies from who they do business with – both their customers and their suppliers. While you can expect any references they give you will likely say good things about them, it gives you a chance to discuss with a neutral party to see if the source is a good fit for the way you do business.

You should also ask for product samples. This gives you a way to see first-hand how a company fulfills an order, the quality of the product they provide, and the way it’s packaged.

Are there different types of sourcing?

Depending on the goods you are trying to procure, you may choose to work directly with manufacturers, source from distributors, or use wholesalers. Here are sourcing examples of how these relationships might work:

- Working directly with manufacturers cuts out the middleman and may allow you to get products at the most affordable price. Not every manufacturer will work with every vendor directly, however, or they may have MOQs that exceed your abilities.

- Working with a wholesaler may allow you to get products from multiple vendors. That way in case a particular manufacturer is unable to provide you with what you need, they can still fulfill your order switching to another vendor. You will pay a mark-up on goods to work through a wholesaler, but you’ll also get better pricing than through the open market – unless you can buy direct.

- Some manufacturers only sell through distributors. If that’s the case, ask the manufacturer for a list of recommended distributors to make sure you can trust the supply chain.

What else should I know?

Keeping your shelves stocked with the right number of products is the goal. If you have too many products in your warehouse, you increase your holding costs and run the risk of getting stuck with products that aren’t selling. Too few products on the shelves can lead to stock-outs and frustrated customers.

Sourcing suppliers will take an investment upfront but it’s key to creating an efficient supply chain. It’s just the beginning of the supply chain as you lock in vendors that can provide the quality of goods you need at a price point that works for your business.

We’ve all seen what happens when the supply chain breaks down. It leads to lost sales, unhappy customers, and can damage a company’s reputation.

REFERENCES

1 ICH Q8(R2). Pharmaceutical Development. Current Step 4 version dated August 2009.

2 Joiris E, et al. Compression behavior of orthorhombic paracetamol. Pharm Res. 1998; 15(7): 1122-1130.

3 Leane M, Pitt K, Reynolds G. A proposal for a drug product Manufacturing Classification System (MCS) for oral solid dosage forms. Pharm Dev Technol. 2015 Jan; 20(1): 12-21.

4 Gamble JF, et al. Application of image-based particle size and shape characterization systems in the development of small molecule pharmaceuticals. J Pharm Sci. 2015; 104(5): 1563-1574.

5 Vippagunta RR, et al. Investigation of Metformin HCl Lot-to-Lot Variation on Flowability Differences Exhibited during Drug Product Processing. J Pharm Sci. 2010; 99(12): 5030-5039.

6 Depasquale R, et al. The Influence of Secondary Processing on the Structural Relaxation Dynamics of Fluticasone Propionate. AAPS PharmSciTech. 2015; 16(3): 589-600.

7 Variankaval N, et al. From form to function: Crystallization of active pharmaceutical ingredients. AIChE J. 2008; 54(7): 1682-1688.

8 Hadjittofis E, et al. Influences of Crystal Anisotropy in Pharmaceutical Process Development. Pharm Res. 2018; 35; 2374-2379.

9 Ferreira AP, et al. Enhanced Understanding of Pharmaceutical Materials Through Advanced Characterisation and Analysis. AAPS PharmSciTech, 2018; 19(8): 3462-3480.

10 Chan M. The Effect of a Source Change for an Active Pharmaceutical Ingredient (API) or Excipient on the Finished Drug Product. A thesis presented to the University of Waterloo in fulfilment of the thesis requirement for the degree of Master of Science in Pharmacy. 2016.

4,506 total views, 4 views today